10:17 am (Hawaii) So what does this half-assed solution to the Greek debt crisis mean? How did it spur the indices higher through the closing bell? Was it all just AAPL?

How much of it was end-of-month window dressing? How many of those same fund bosses sell their AAPL and other assorted non-essentials tomorrow before the peon premarket?

A meltdown in Greece, then Portugal, then Spain, France, UK ... wouldn't all of this have left gold and silver alone to run higher and higher? Are we really that much closer to the stack-your-cans-of-sardines-and-Spam days?

One thing is clear. The daily charts show many, many silver plays with fairly bullish candlestick charts. I don't think it's an all-clear that silver shoots up vertically from here, but it's something to watch.

Big Apple

A major gap open and strong finish on increased volume. Under normal conditions, what's not to like, right? But even AAPL can't withstand the unnatural currents of the global market.

Crude activity

What's good for crude oil is good for the market? Not necessarily, but Sensei Turd Ferguson has been forecasting a crude move to the upside.

Silver hammers

AGQ, AG, EXK, SLV all have hammer candles that are somewhat bullish. It's not enough for me to jump in head first, so I'm still 90% cash. But it's getting attractive.

In an afternoon update,

Turd pointed to 37.50 as an area of "stout support", with

a re-test of 39.50 soon. I suppose I'm selfish wanting prices below 35 to buy physical.

Gold isn't looking as interesting, which is expected after last week's move (and the sputter action of silver). I don't know what to make of XG's candle today except that it finished with some momentum. An oddity.

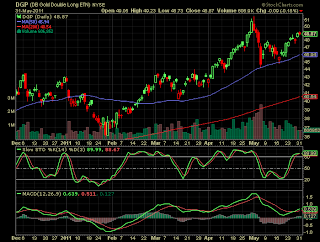

The gold junior miners ETF looks nice, but GLD looks tired. It might be time for some consolidation. I'm still positive on gold in general, still holding a small piece of DGP, which also looks tired here.

Rare earths are foreign to me, but MCP looks full of vigor here.

If you look hard enough, the palladium ETF chart looks a little bit like XG. Bullish, but something's not quite right.

Copper ETF looks positive, but is all the news out of China already baked in? Copper was a good play a week ago when China's growth turned up strong, but this is a tightrope here. Long term, I wouldn't fear this trade, but I can't hold anything that long in this market.

I'm sticking to my gut for now and staying mostly out. AAPL will be interesting if it holds its ground, but much of that depends on the chaos in the Euro zone and, well, just about everywhere else.

SGS is skeptical about PMs and noted earlier that if gold can't keep up, silver will be ravaged by the puppet masters.

A pullback in PMs would be par for the course. Gold, in particular, tends to pull back on any gains during the summer. It has the last two summers. I'd look to add more physical on discount prices as volume wanes and the lulls take over.