11:32 am (Hawaii) Technical Knockout? Huge volume in both FAS and FAZ. Even with normal profit-taking, FAS is up 17% to 16.45, blasting through that 15.00 level. If the myth/lie can be perpetuated out of Euroland, FAS could rise into the 20s rapidly.

FAZ is barely able to hold above 35, which had been my hope for a new entry point. I'm waiting this out to see how the market reacts. Fuck theory and logic. If hedge funds and mutual funds pour in for Nov and Dec madness, it doesn't matter how smart or clever your theory is about the disintegration of the Fiat monetary system. Not until 2012, anyway.

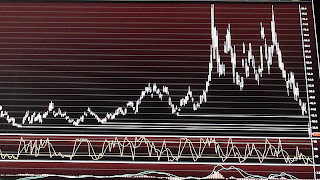

FAS daily

Completely ripped through megaphone levels

without QE3, unless this Euro Bailout is the same.

15.00 was a possibility, now 25 is in the picture!

FAS daily

The first uptrend lasted 7 days.

The new one barely lasted 7 days, seemed ready

to dip on day 8 (yesterday) and has surged back

to the top of the current level.

FAS daily

Major volume - short covering? - today.

FAZ daily

42 was the new thin ice.

Now 35 is in play, new territory.

FAZ daily

Snapback action could be coming, but I'm not

inclined to bet against the banksters yet.

FAZ daily

Currently below 1-year lows.

FAZ daily

No comments:

Post a Comment