Preposterous. Ridiculous. Ludicrous. There are all kinds of words to describe the carnage done to some of the world's best publicly traded companies. But the reality is, like the last homeowners who try to stand in the way of a lava flow, logic has nothing to do with it. You either get out and save yourself, or stay put and get steamrolled by tons of fiery magma.

Simple as that. Simplicity is rarely easy to execute, of course.

Even Potash can't escape the storm. Not cheap, though, even now.

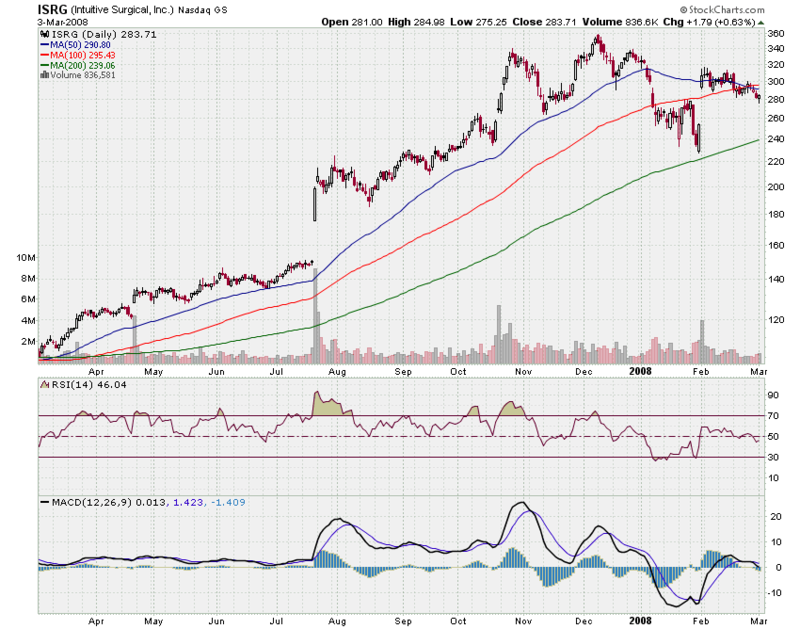

What do you do with good stocks gone bad? Best to wait it out.

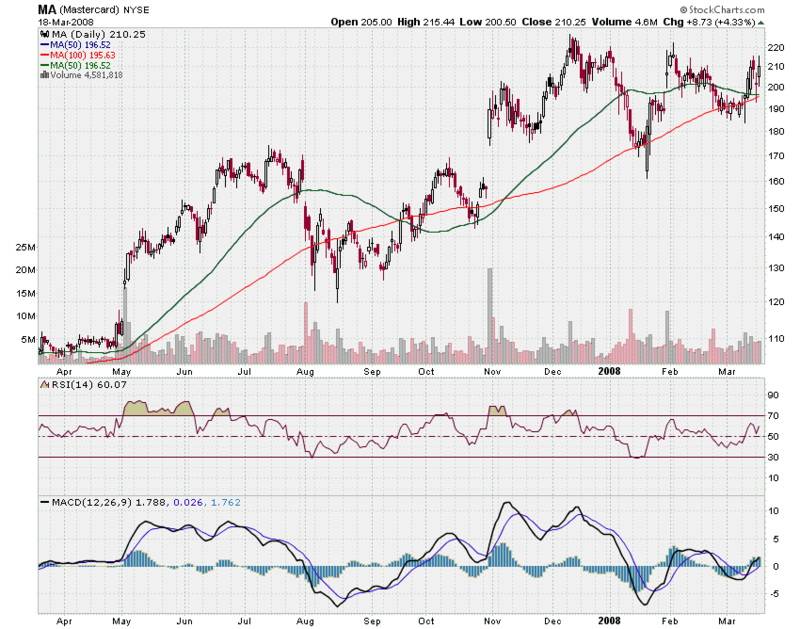

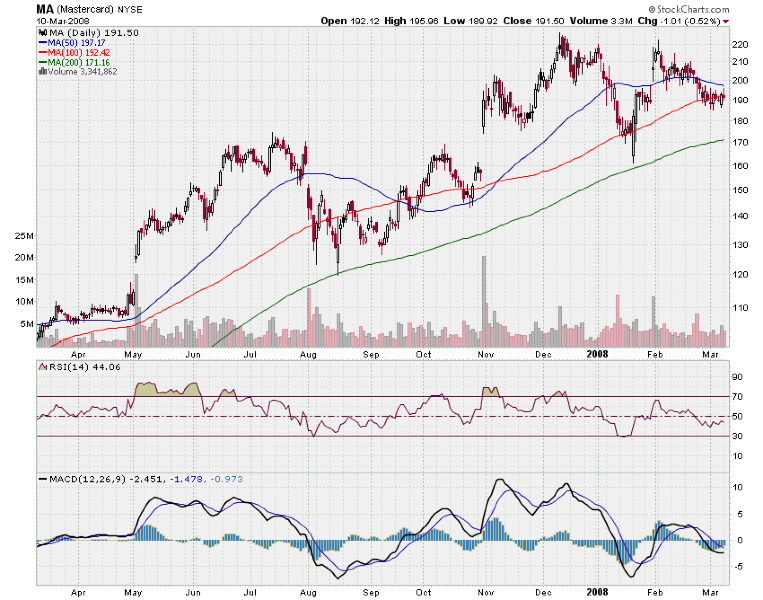

This is real strength here. Impressive, but not a reason to dive in.

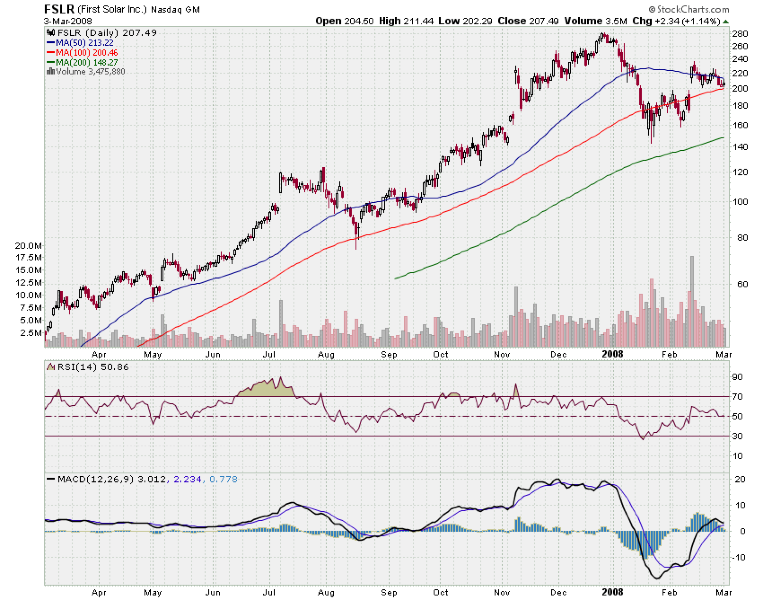

All the solars fell off a roof, including the best of breed. Not cheap. Not yet.

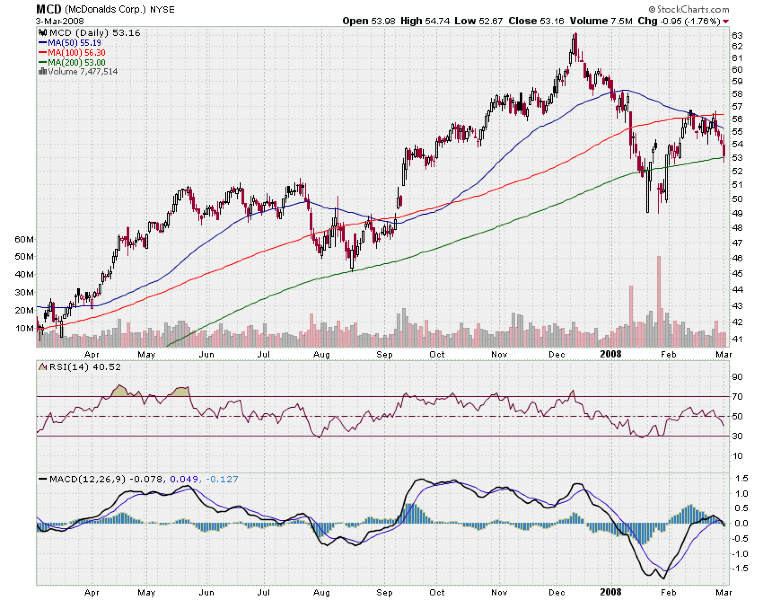

Mickey D cuts against the grain. Not cheap anymore.

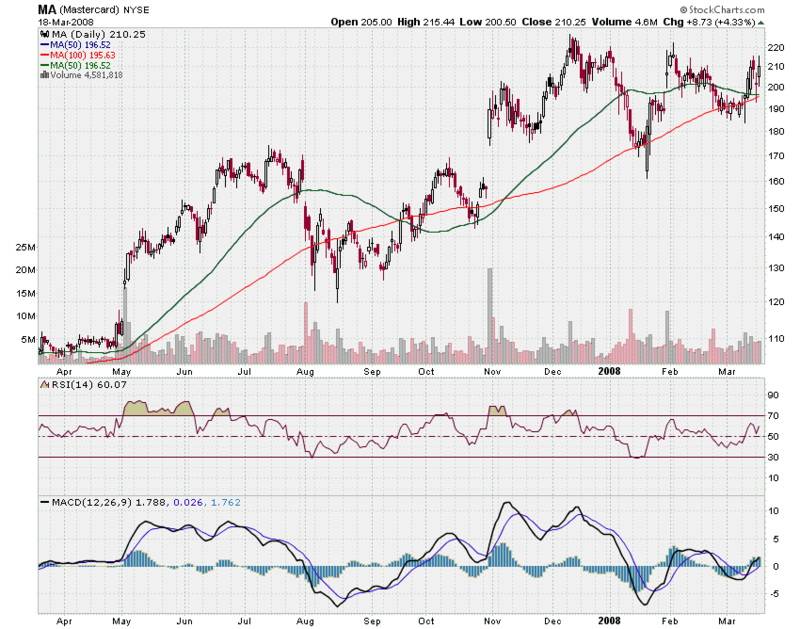

This chart defies the rest of the market.

Interesting that PetroChina dropped while its cousin CNOOC gained.

Not a thing wrong with Disney. Just caught in the tide.

Flowserve takes another hit, but still not cheap.

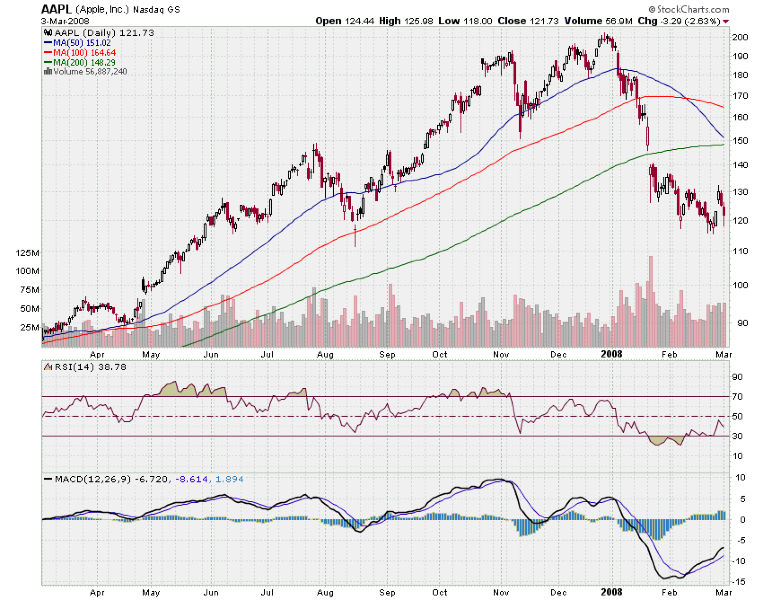

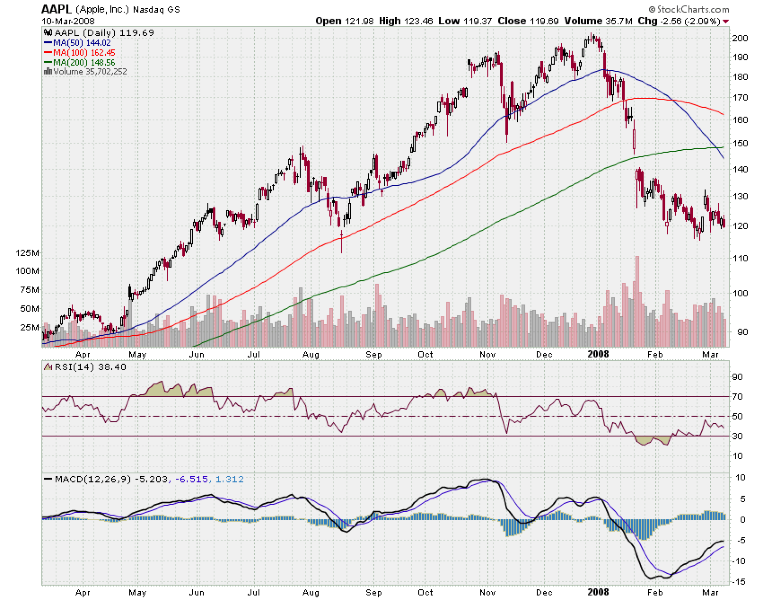

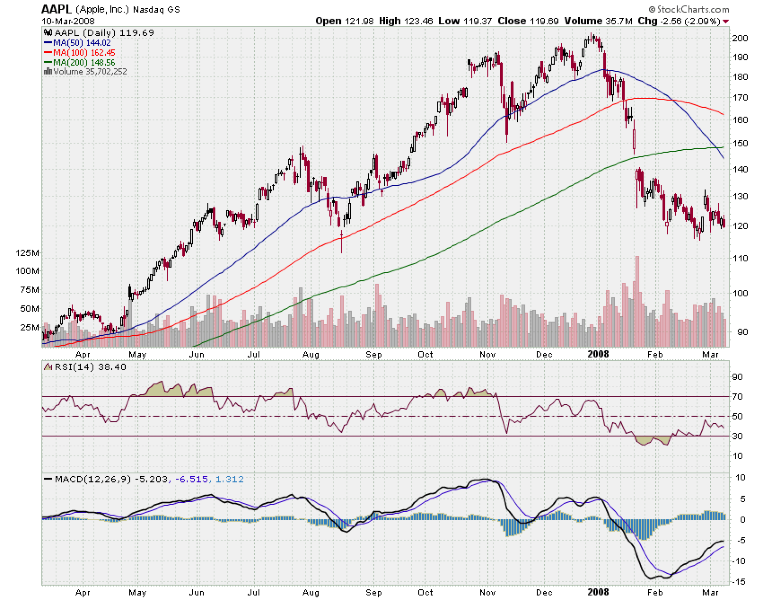

Apple looks cheap, but who dares to enter?

China Mobile? Now

this looks cheap. I just don't trust it.

This is beyond cheap. I don't have the guts (or lunacy) to go near, though.

Like Apple, RIMM is another stock that gets pillaged and plundered en masse by the big boys.

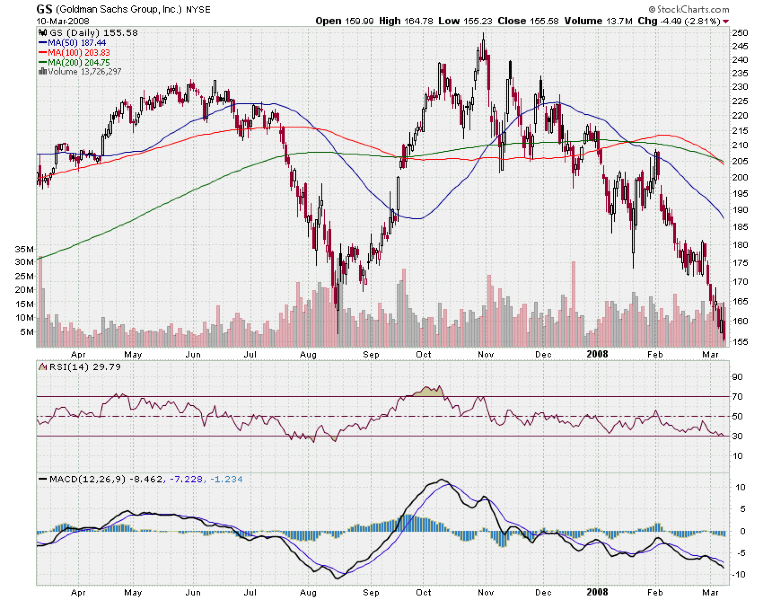

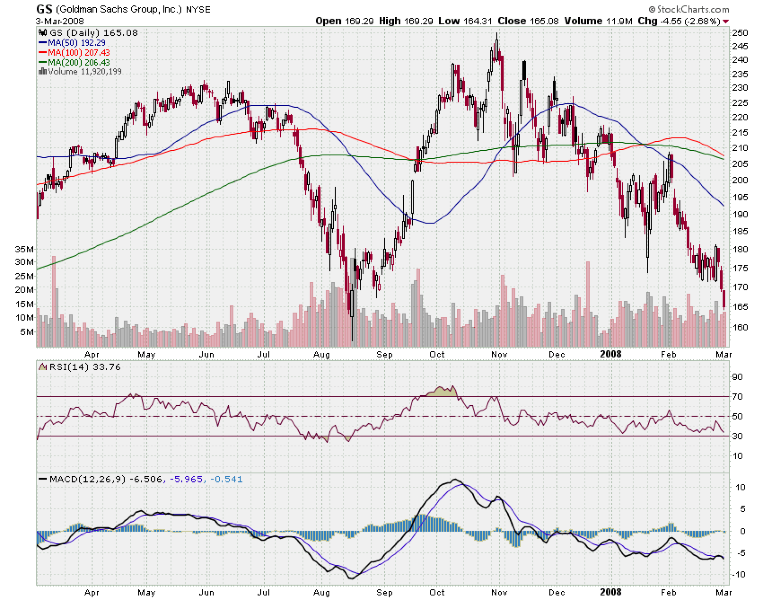

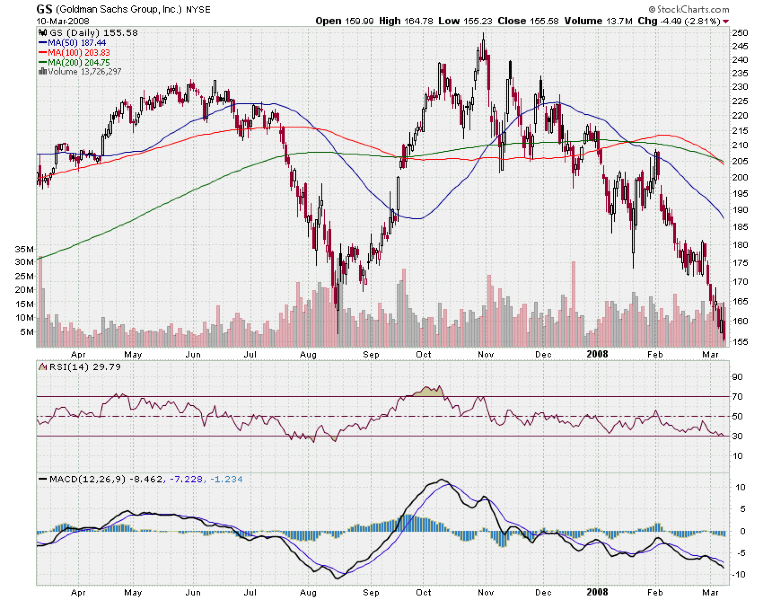

Goldman Sachs is tempting below 165. But I'll just watch for now.

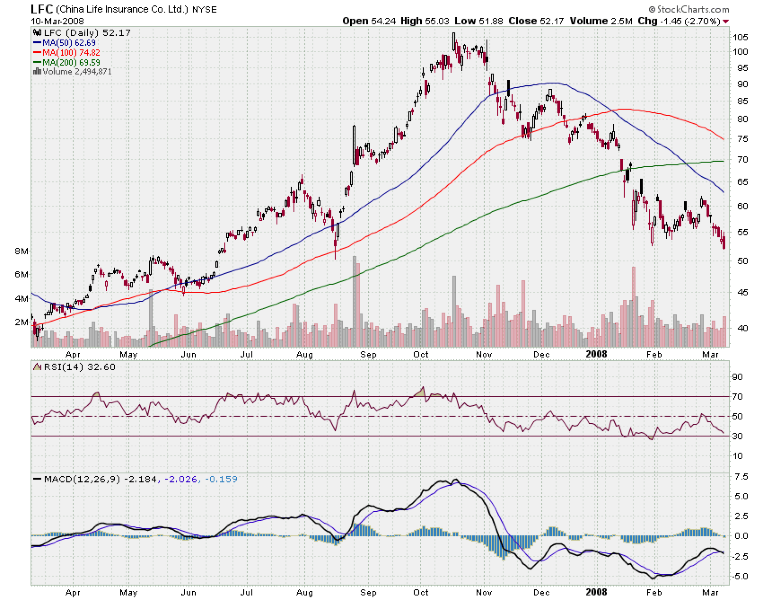

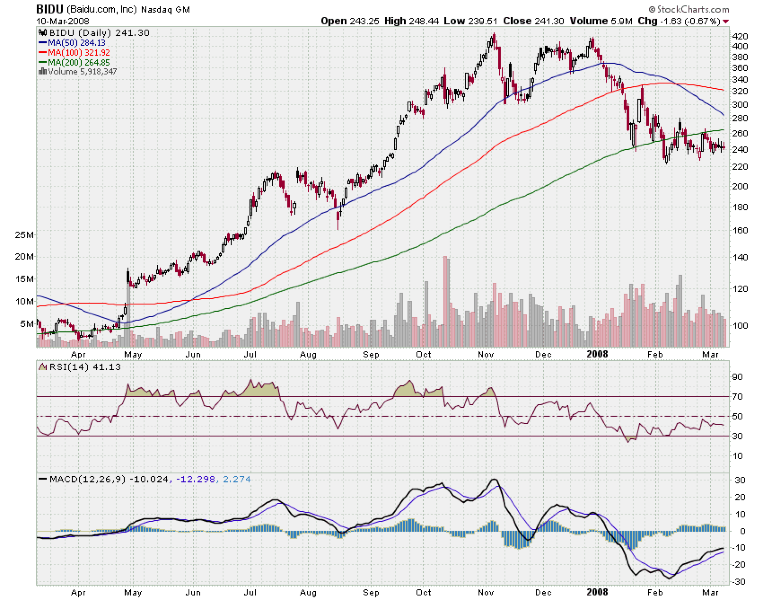

When will China bounce back?

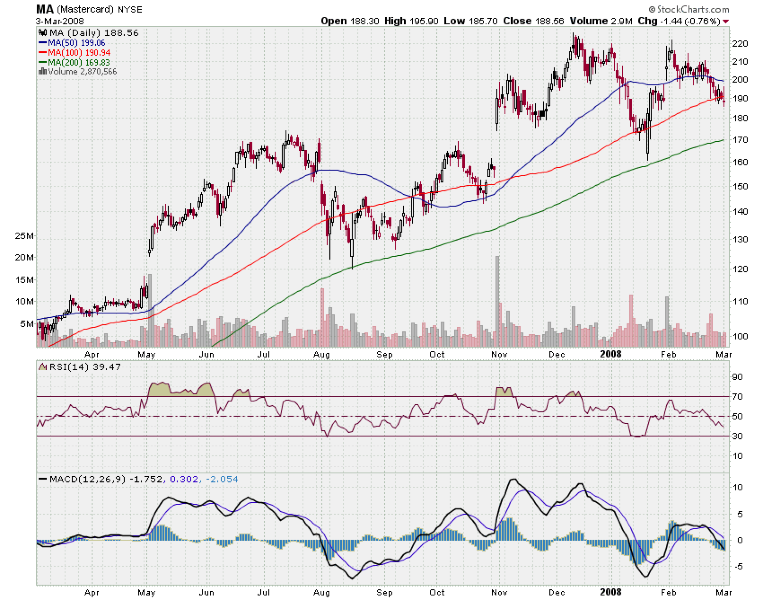

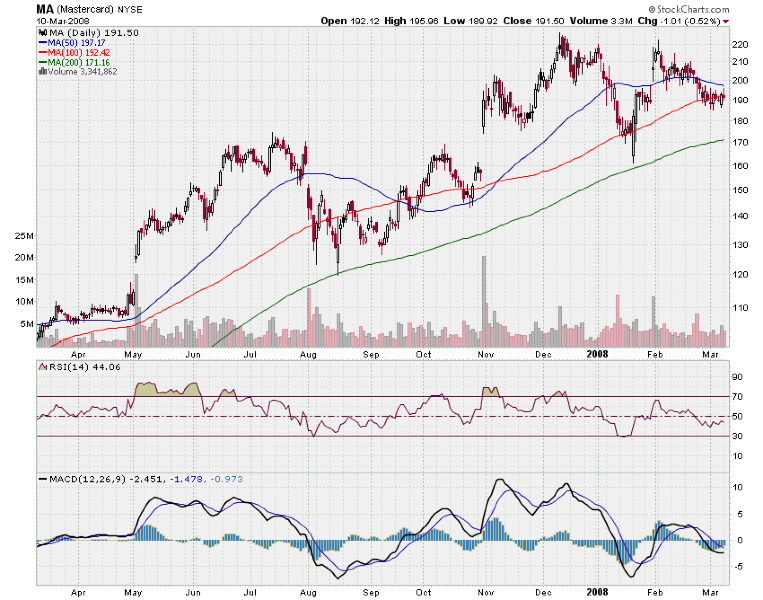

Not cheap at all.

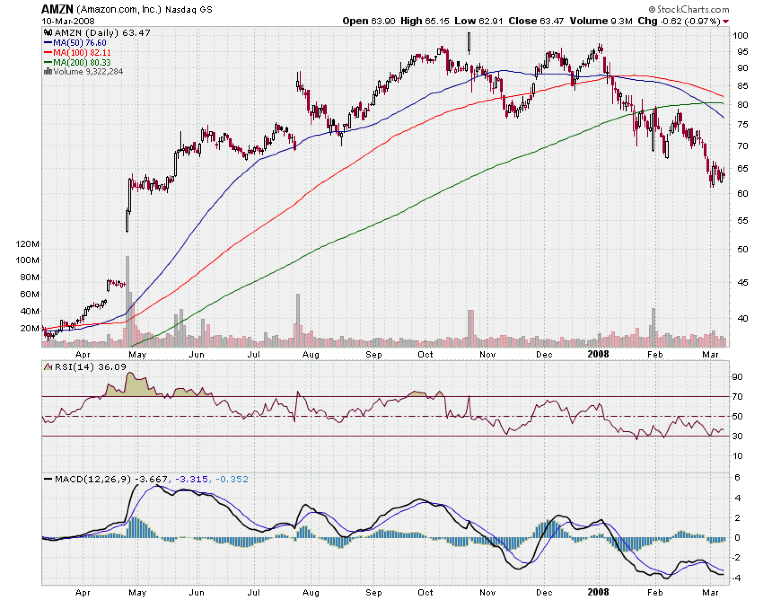

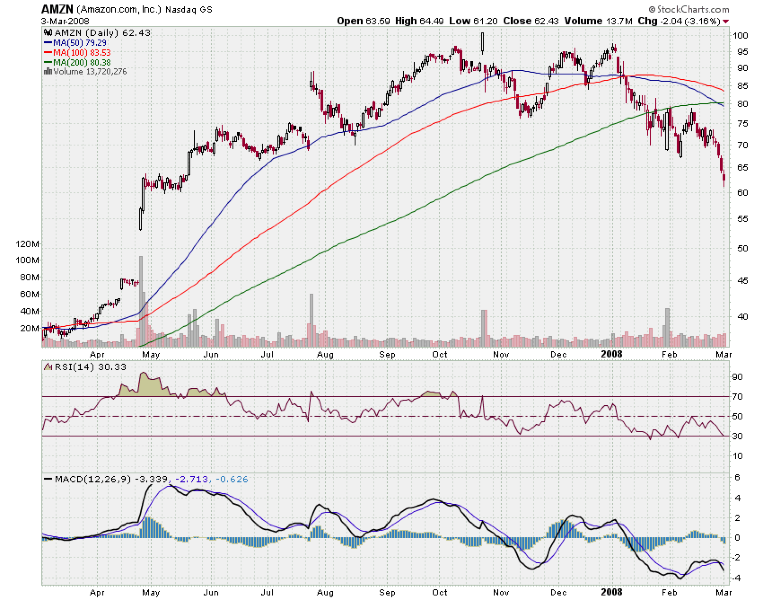

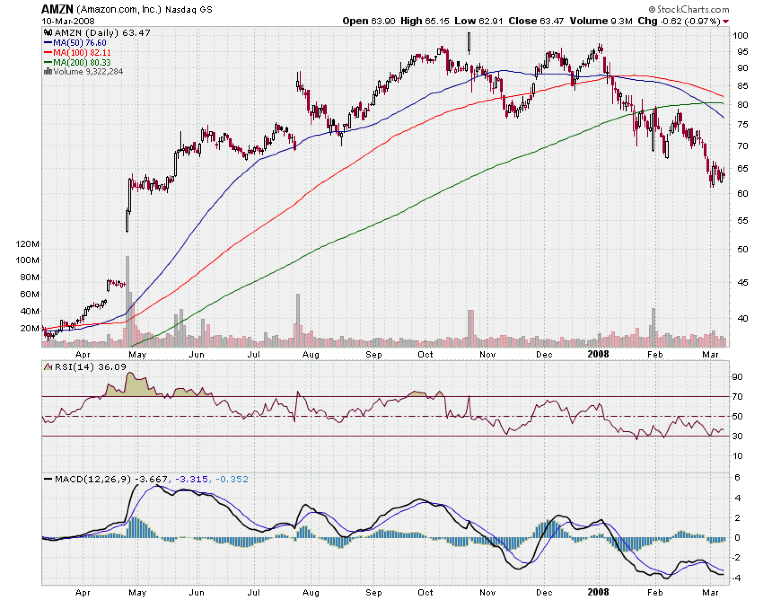

Amazon has a tendency to stay below the sand before blooming just a few times a year.

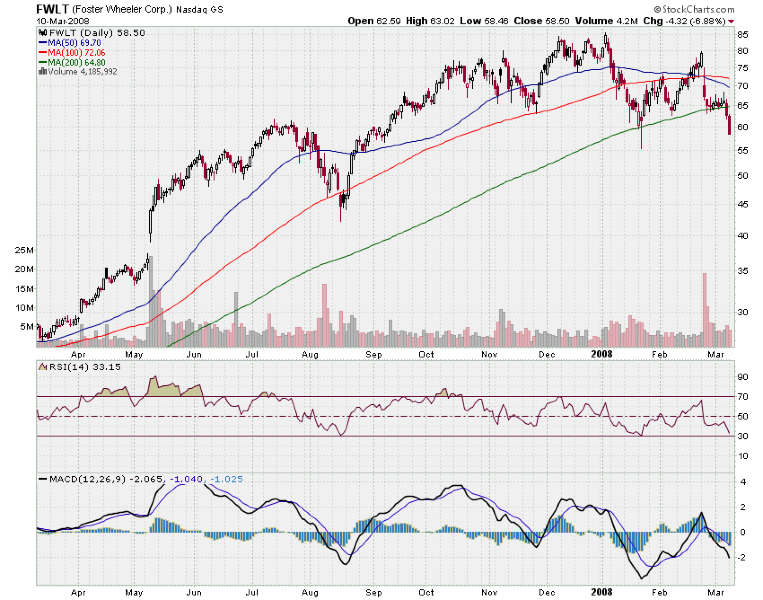

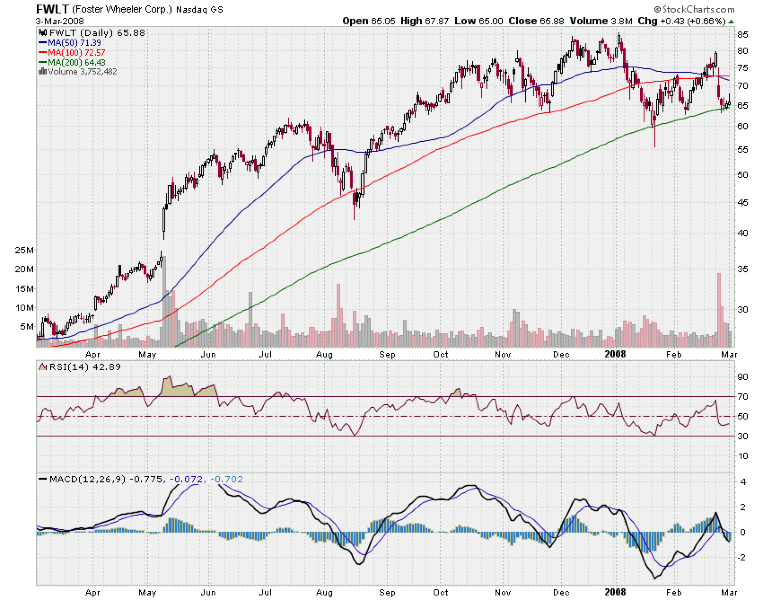

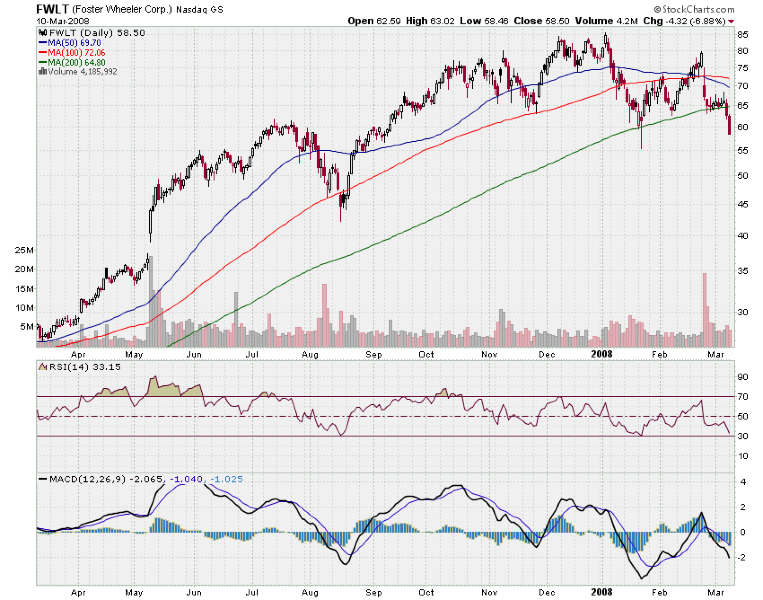

The CEO said the company will do a repeat of last year. In other words, FWLT is entering the strength of its fiscal year.

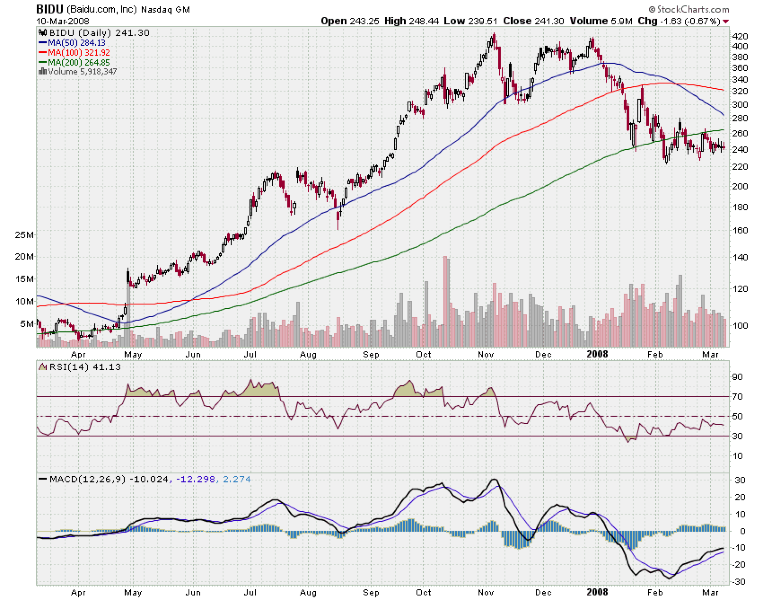

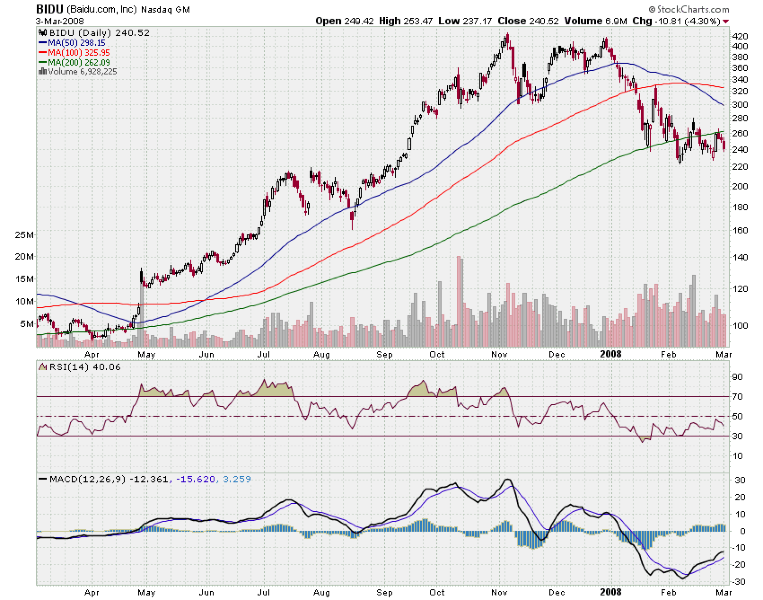

China still spooky, but I'm watching.

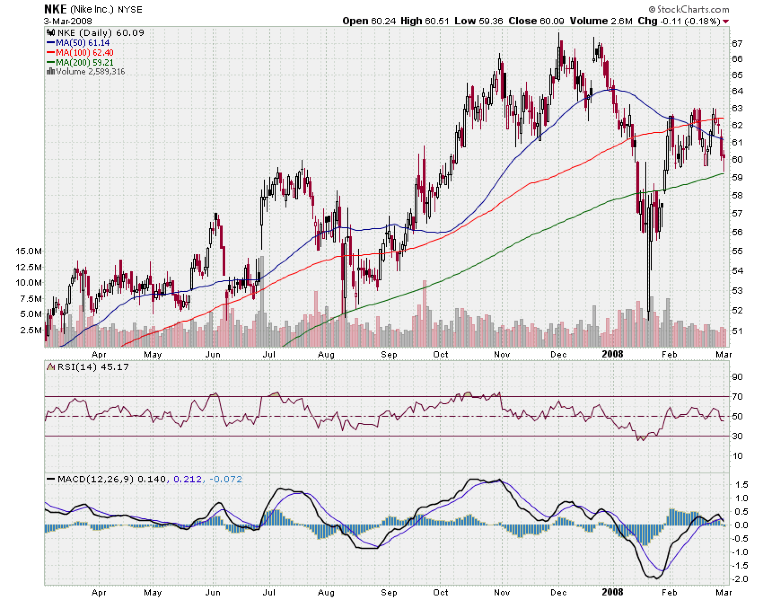

Nike is cheap again.

Value is here, but can MSFT really grow?

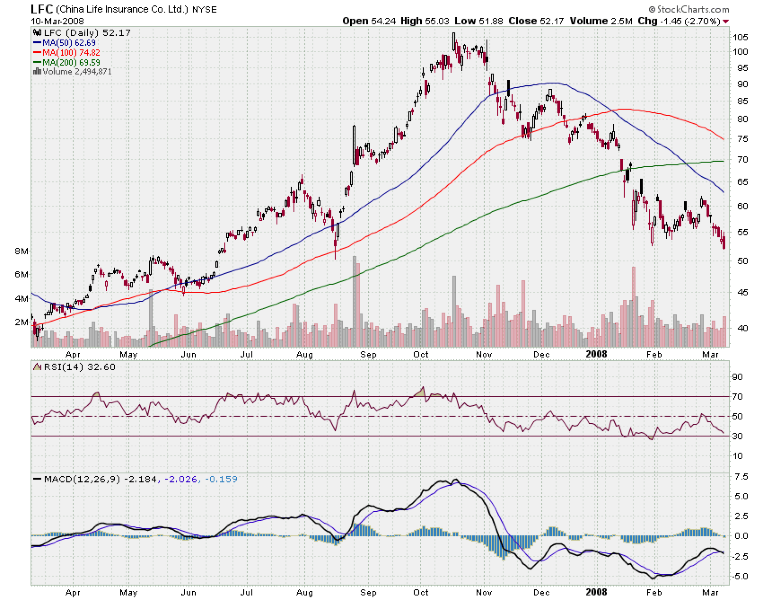

I just have a strong belief that life insurance in China will win.

Like FSLR, STP got beaten to a pulp.

Well-run company, but subject to any economic slowdown. I'm real close to dropping Chipotle out of my Top 25.

Apple looks cheap, but who dares to enter?

Apple looks cheap, but who dares to enter?