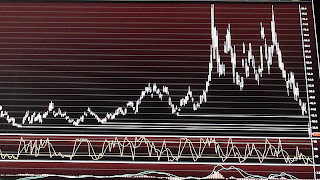

Every now and then I visit American Bulls for their take on the market. Here's what their candlestick analysis looks like as of Oct 31.

FXP - Buy confirmed

FCX - Sell if

FAS - Sell if

MF - Wait

BAC - Wait

NBG - Sell if

STD - Wait

JPM - Sell if

GS - Sell if

GLD - Sell Confirmed

DGP - Sell Confirmed

SLV - Sell if

AGQ - Hold

UUP - Buy Confirmed

FAZ - Buy Confirmed

EUO - Buy Confirmed

SPY - Sell if

AAPL - Hold

NFLX - Wait

CSTR - Wait

LULU - Sell if

GOOG - Hold

BIDU - Hold

GMCR - Sell if

Reggie Middleton: The ironic, prophetic nature of MF Global bankruptcy (Oct 31)

Le Fly: Haunted banks (Oct 31)

Le Fly: Now let me tell you what I really think of the EFSF (Oct 31)

Mark Garbin: A glimpse into the future - Why I'm optimistic (Oct 29)

Vlogs

Mark Garbin: A glimpse into the future - Why I'm optimistic (Oct 29)

Vlogs

endlessmountain: Accounting, gold and silver (Oct 31)

endlessmountain: JPMorgan to silver price ratio (Oct 31)

James Turk: Guest Adam Fergusson (Oct 31)

Hit the Bid: End of days with Daytrading Dina (Oct 31)

Hit the Bid: Krull to Arms (Oct 31)

silverfuturist: Margin Call - best movie this year (Oct 31)

streetmoney21: If you are losing at your own game, just change the rules (Oct 29)

Real News: Bank of America's death rattle (Oct 29)

MoneyBags73: Google Trends of silver price gives us insight (Oct 29)

Audio

Chris Martenson: Guest Paul Tustain (Oct 31)

Chris Martenson: Guest Paul Tustain (Oct 31)

Peter Schiff Radio (Oct 31)

Tim Monk Radio: Guest Turd Ferguson (Oct 28)

Mainstream

Reuters: Greek referendum disappoints markets (Nov 1)

Reuters: All eyes on Euro downside (Nov 1)

Euronews: Greek vote plan sends stocks sliding (Nov 1)

Euronews: Greek bailout referendum stirs strong feelings (Nov 1)

Reuters: Bove says MF Global meltdown to lead to more regulation (Oct 31)

Reuters: MF Global files for bankruptcy (Oct 31)

Fantasy Football

dereksdiary: Tape review of Tebow and Broncos (Oct 31)