Is seeing believing? Apple stores were jam-packed with buyers of the new iPhone. I certainly wasn't one of them. For me, a free online game of Pac-Man is still blazing-hot and exciting.

For most of the tech-savvy world, though, the new iPhone is a must-have. So seeing is believing. Then again, once AAPL's earnings report came with a forecast of not-so-sensational expectations, the stock plummeted and opened on Tuesday at 146, down 16 or so. It wasn't that long ago when the stock was at 120. In May, AAPL was at 191. Which is the right price?

Both, probably. The market isn't someone I'd hang out with these days. Skittish. Fickle. Paranoid. At 146, AAPL was a steal, obviously, and has since returned to the 160s just one day after the panicked selloff. No iPhones necessary for me, but a few more shares of the stock might be the right order sometime soon.

Wednesday, July 23, 2008

Wednesday, July 16, 2008

Dead cat bounce?

The market could not tank one more day. At least not today. Apple has held its ground at 171, not bad considering the rocket ride from 120 to 190 in the first half of this year. Google has stayed firm above 500. Neither are bargains at this point though.

Visa slipped below 67 yesterday and is hanging around 70 now. Is V a bargain below 70? Maybe. MasterCard is also rebounding nicely today. Until there is a revolution in the transaction-handling business, those two will continue to make out like bandits. It's like gas prices. No point in bitching about them. If you can't beat 'em, might want to join 'em.

The picking is slim. So many stocks that were on Cloud 9 six months or a year ago have been torched. Pain is everywhere. But the survivors stand out even more now. I still wonder which of the alternative energy stocks will win over the long haul. First Solar is clearly the frontrunner.

Visa slipped below 67 yesterday and is hanging around 70 now. Is V a bargain below 70? Maybe. MasterCard is also rebounding nicely today. Until there is a revolution in the transaction-handling business, those two will continue to make out like bandits. It's like gas prices. No point in bitching about them. If you can't beat 'em, might want to join 'em.

The picking is slim. So many stocks that were on Cloud 9 six months or a year ago have been torched. Pain is everywhere. But the survivors stand out even more now. I still wonder which of the alternative energy stocks will win over the long haul. First Solar is clearly the frontrunner.

Tuesday, July 15, 2008

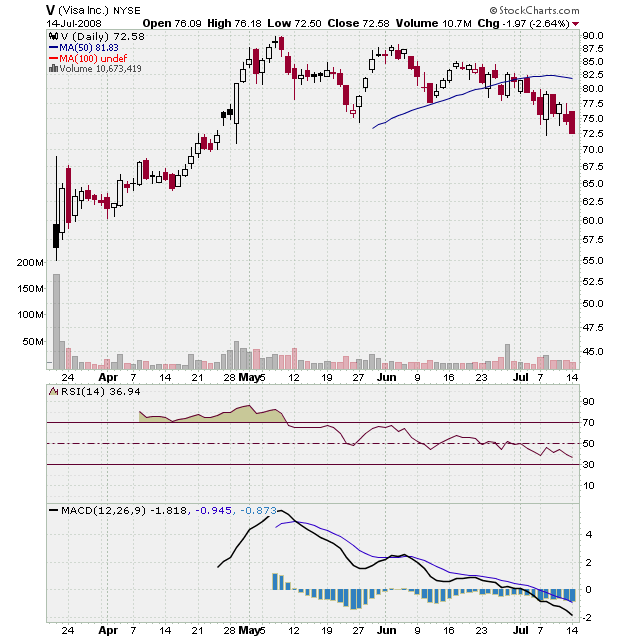

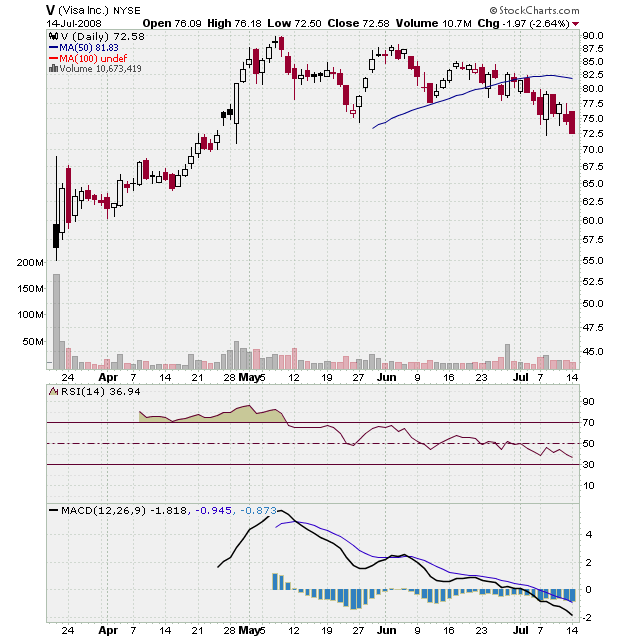

Mr. Brown liked Visa then, but now?

Back in late April, my old pal Mr. Brown was severely bullish on Visa, though I was cautious. I warned about the eventual selloff that comes with any IPO (Google went from 120 to 80 in its first year) and preferred to wait. Well, Mr. Brown's bullish stance was proven right. V ran from 75 in April to 90 by early May.

Yowza. However, Visa has sold off some since. V has dipped three times, really, going to 75 in late May, running back to 88 before June, dipping to 77 and rising to 85 in June. Visa is currently at 72.

I'm more comfortable with the idea of buying MasterCard, but I can't argue against Visa. I'm not a fan of the whole concept of credit cards (and how they have most American consumers by the neck), but I am a fan of the way they churn gargantuan profits.

With Freddie Mac and Fannie Mae scaring the crap out of anyone with ties to financials, this may not be the best time to load up on shares of V. But at 72, this could also be a relative bargain.

Yowza. However, Visa has sold off some since. V has dipped three times, really, going to 75 in late May, running back to 88 before June, dipping to 77 and rising to 85 in June. Visa is currently at 72.

I'm more comfortable with the idea of buying MasterCard, but I can't argue against Visa. I'm not a fan of the whole concept of credit cards (and how they have most American consumers by the neck), but I am a fan of the way they churn gargantuan profits.

With Freddie Mac and Fannie Mae scaring the crap out of anyone with ties to financials, this may not be the best time to load up on shares of V. But at 72, this could also be a relative bargain.

Monday, July 14, 2008

No B.S. by Barron's

Back on February 24, I noted a Barron's story that feted oil companies that had interest in the Bakken Shale on the Canada-U.S. border. Not very big on this kind of stuff, I decided to start a mock folio to keep track.

Here we are, more than four months later, and four of the five stocks noted by Barrons are in the black since.

WLL | then 59 | now 102 | +72%

EOG | then 100 | now 119 | +18%

BEXP | then 7.13 | now 16.04 | +125%

CLR | then 25 | now 81 | +225%

MRO | then 51 | now 45 | -11%

Overall, on a weighted basis, this quintet of oil stocks are up a nice 86%. Amazing. Meanwhile, here in Hawaii, I paid $4.31 for a gallon of regular unleaded. That's the cheapest I found in urban Honolulu, aside from Costco.

Here we are, more than four months later, and four of the five stocks noted by Barrons are in the black since.

WLL | then 59 | now 102 | +72%

EOG | then 100 | now 119 | +18%

BEXP | then 7.13 | now 16.04 | +125%

CLR | then 25 | now 81 | +225%

MRO | then 51 | now 45 | -11%

Overall, on a weighted basis, this quintet of oil stocks are up a nice 86%. Amazing. Meanwhile, here in Hawaii, I paid $4.31 for a gallon of regular unleaded. That's the cheapest I found in urban Honolulu, aside from Costco.

Subscribe to:

Posts (Atom)