Thursday, February 28, 2008

Cramer fired up over satellite radio

I figure my pal Kyle and everyone else who is long XM Satellite Radio would get a kick out of Jim Cramer's rant about the XM-Sirius merger delay.

Oil stocks still gushing

Chalk up another brilliant day for oil stocks. Barron's listed five over the weekend and four were up today. For the week thus far, all five are up at least 4.1%. EOG had the biggest lift today, surging 18%, after announcing a strong production forecast. All five have their feet in North Dakota's Bakken Shale. Here's a look at how each stock has fared, with Monday's opening price and today's closing price.

WLL | 59.49 | 61.95 | +4.1%

EOG | 100.27 | 124.73 | +24.4%

BEXP | 7.13 | 8.09 | +13.5%

CLR | 25.05 | 28.98 | +15.7%

MRO | 51.54 | 54.15 | +5.1%

On the whole, a weighted scale of these stocks gives the five a net gain of 12.6%. In a bear market.

WLL | 59.49 | 61.95 | +4.1%

EOG | 100.27 | 124.73 | +24.4%

BEXP | 7.13 | 8.09 | +13.5%

CLR | 25.05 | 28.98 | +15.7%

MRO | 51.54 | 54.15 | +5.1%

On the whole, a weighted scale of these stocks gives the five a net gain of 12.6%. In a bear market.

Wednesday, February 27, 2008

Google tossing a wrench into MicroHoo

Michael Arrington loves the rumor mill. Can't blame him. I mean, Google buying a chunk of Yahoo? How gossipy and unlikely is that?

Barron's effect juiced by crude behavior

Over the weekend, Barron's got bullish on oil stocks with ties to the Bakken Shale of North Dakota. With crude oil near 102, Barron's timing could not be better. Here's how each of the five stocks have done since Monday's open, with closing prices on Tuesday and today.

Whiting Petroleum (WLL) | 59.49 | 60.85 | 60.97

EOG Resources (EOG) | 100.27 | 108.23 | 105.68

Brigham Exploration (BEXP) | 7.13 | 7.28 | 7.38

Continental Resources (CLR) | 25.05 | 25.83 | 28.10

Marathon Oil (MRO) | 51.54 | 53.43 | 54.36

Whiting Petroleum (WLL) | 59.49 | 60.85 | 60.97

EOG Resources (EOG) | 100.27 | 108.23 | 105.68

Brigham Exploration (BEXP) | 7.13 | 7.28 | 7.38

Continental Resources (CLR) | 25.05 | 25.83 | 28.10

Marathon Oil (MRO) | 51.54 | 53.43 | 54.36

UGA could score touchdowns

Any acronym that reads "UGA" is a bit unsettling for Hawaii football fans. After all, it was just seven weeks ago when Georgia (UGA) walloped our Warriors in the Sugar Bowl. But I'm getting over it, and UGA has a new meaning for me. UGA is the first gasoline ETF and began trading on Tuesday.

For us in the islands, where a gallon of gas goes for $3.36 (7-Eleven), any opportunity to join 'em if we can't beat 'em makes cents to me.

For us in the islands, where a gallon of gas goes for $3.36 (7-Eleven), any opportunity to join 'em if we can't beat 'em makes cents to me.

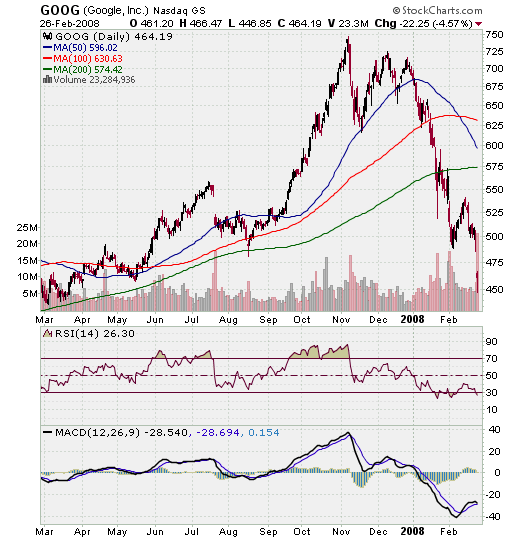

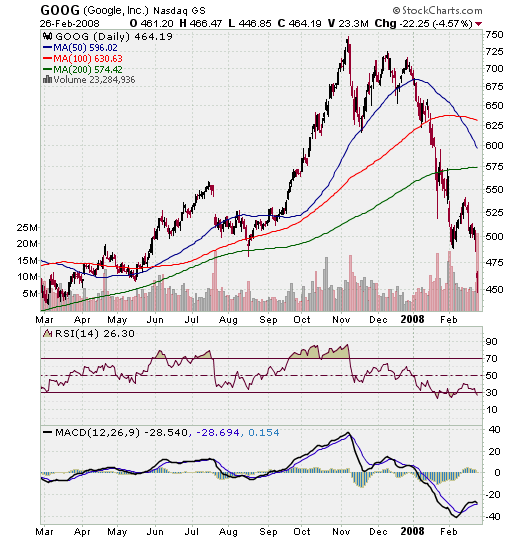

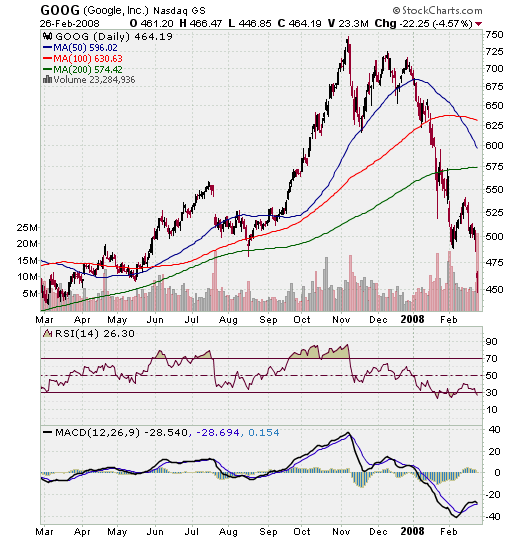

Google bears turning bullish

Is the bottom finally in for Google? Some of Henry Blodget's readers who claim to be former GOOG shorts say yes, more or less.

Tuesday, February 26, 2008

Barron's likes oil

Dudes named Eli tend to be pretty smart. Take Eli Hoffman of Seeking Alpha, for example. The SA editor posted Barron's five promising oil stocks over the weekend. Here they are with Monday's opening price and Tuesday's closing price.

Whiting Petroleum (WLL) | 59.49 | 60.85

EOG Resources (EOG) | 100.27 | 108.23

Brigham Exploration (BEXP) | 7.13 | 7.28

Continental Resources (CLR) | 25.05 | 25.83

Marathon Oil (MRO) | 51.54 | 53.43

More about oil in North Dakota's Bakken Shale in the New York Times.

Good luck drilling, boys.

Whiting Petroleum (WLL) | 59.49 | 60.85

EOG Resources (EOG) | 100.27 | 108.23

Brigham Exploration (BEXP) | 7.13 | 7.28

Continental Resources (CLR) | 25.05 | 25.83

Marathon Oil (MRO) | 51.54 | 53.43

More about oil in North Dakota's Bakken Shale in the New York Times.

Good luck drilling, boys.

Mr. Brown's Picks

Good friend of mine, Mr. Brown, is dipping his toes into stocks, braving very choppy seas. I'm taking a look at his stocks, with more homework on a few due later.

Awesome maaan. I had to look these up. Some I never knew about before.

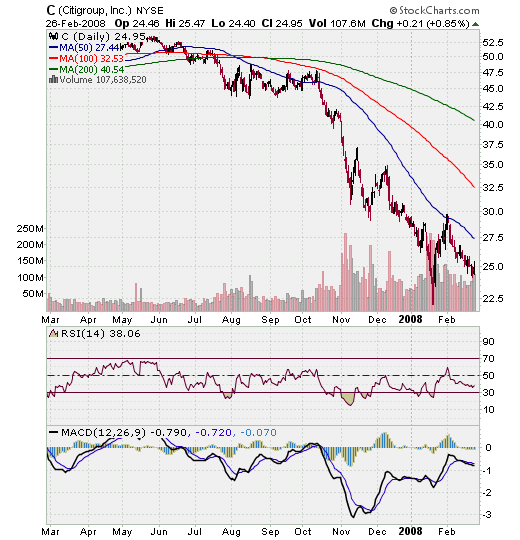

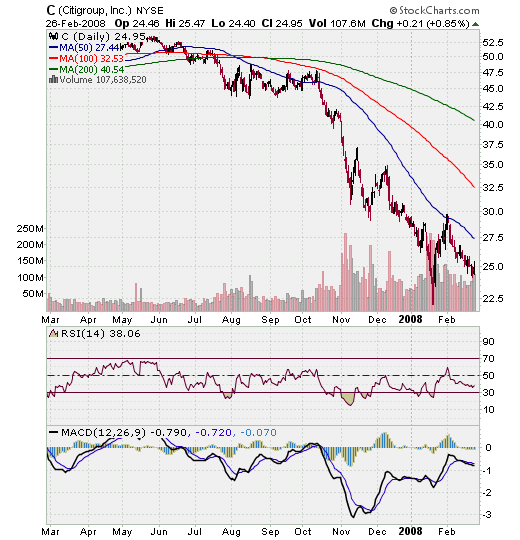

Citigroup (C) is very tempting. They have healthy exposure in China, was one of the first major financial institutions to get really embedded in the new economy there. Ups and downs because of the mortgage mess, but there's more upside than downside from here, I think. I kinda expect at least one more downturn related to the mortgage crisis, but that's bearable.

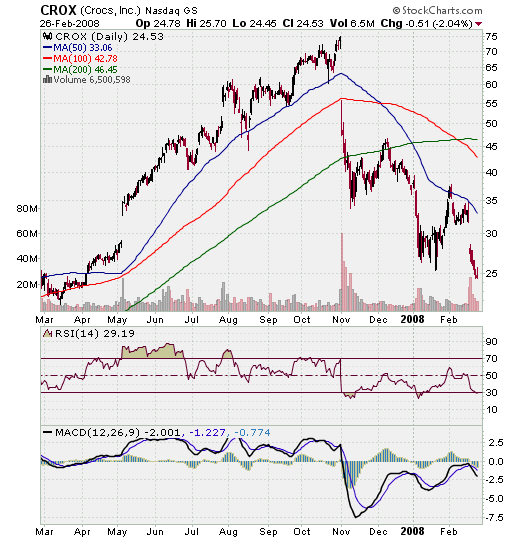

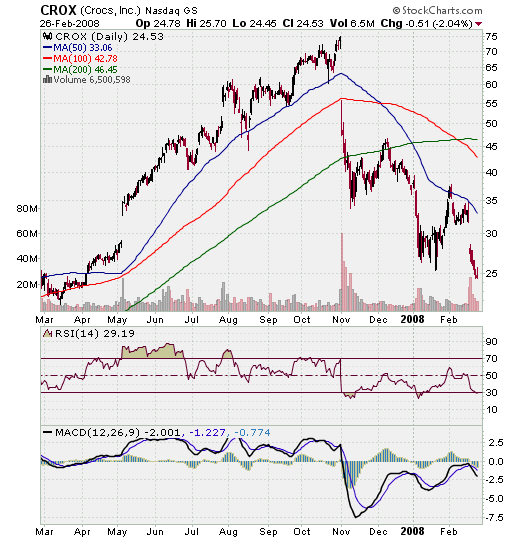

Crocs (CROX) I have to confess I gave up on when I lost a big profit. I wear their sandals, believe in the product. But it went from 40 to 75 and back to below 40. I think it's still a good company but the slowing growth means 75 probably ain't gonna happen with consumer spending tailing off. Maybe 50. That would be a nice profit. I just won't go near it.

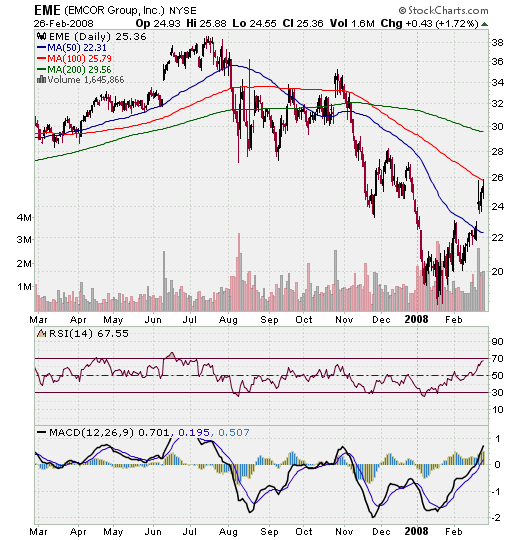

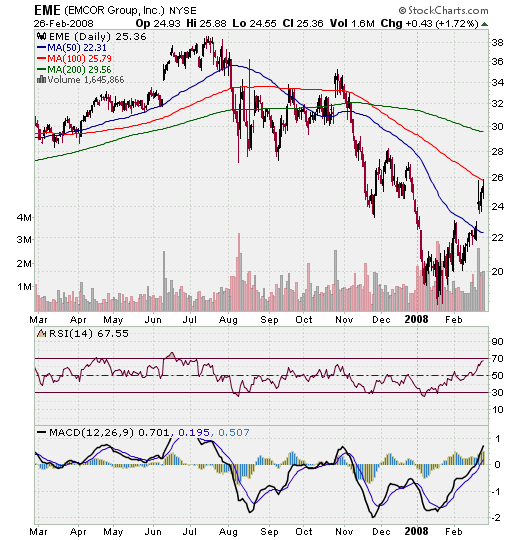

I have no idea what EMCOR Group (EME) does, but the stock is on a big roll. It gapped up last week from 22 to 24 and is now at 25.36. Need to do homework on this puppy.

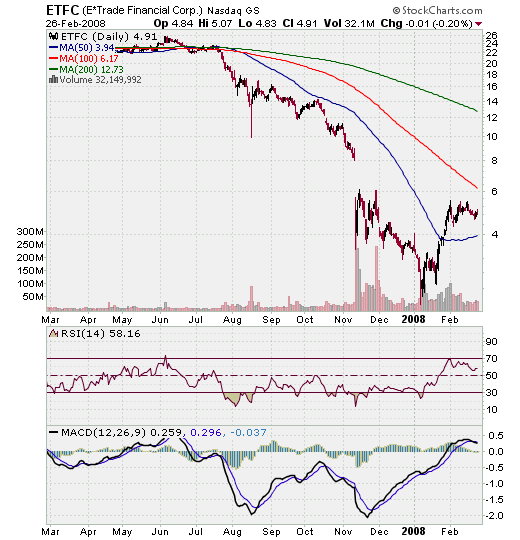

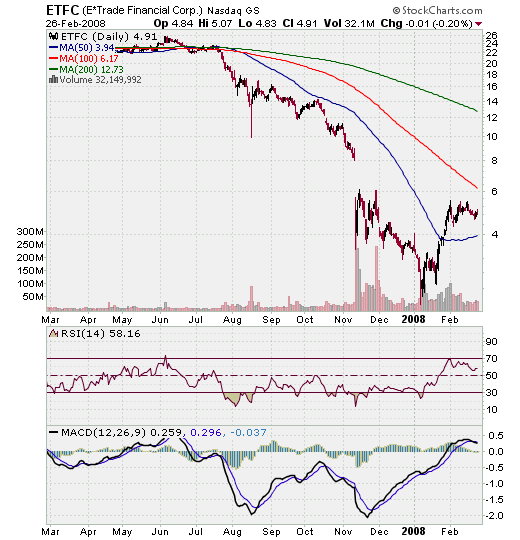

E-Trade (ETFC) I like as an online broker, but there are some serious, ongoing issues in regard to loans. The brokerage is just a small part of the company now so I wonder what the future holds when people make less money (economy, inflation) and default on their loans. When ETFC went below 3, that was just paranoia, though. Doubling to 5 between January and February was the top, I'm guessing. It's gonna take a whole lot to move the stock above 6. I hope it happens.

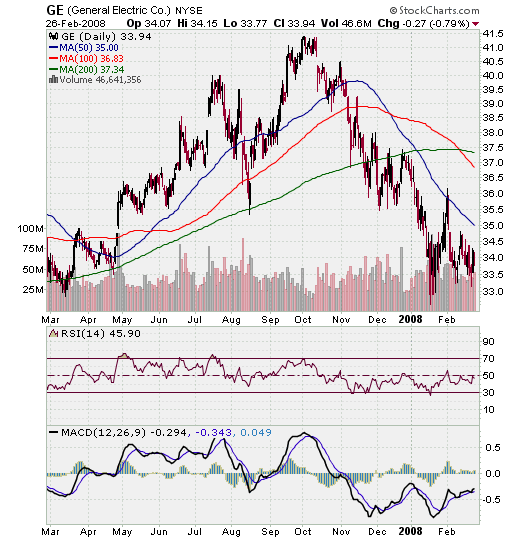

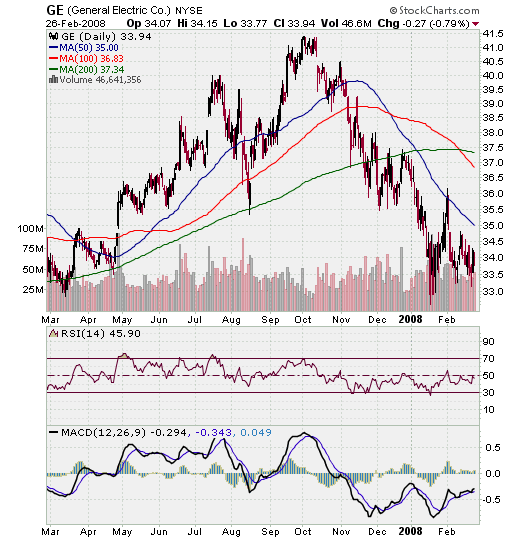

General Electric (GE) is a classic blue-chip, but it's so huge, where's the growth going to come from? It's a safe stock in this bear market, a good addition to the portfolio.

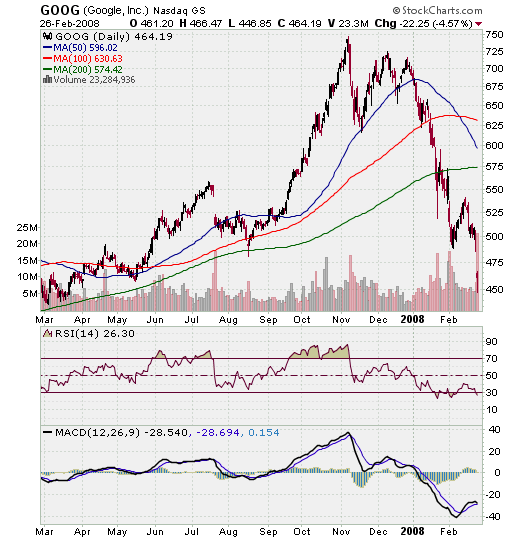

Google (GOOG) will be back. Maybe not to 750 (last November) right away, but at 464 today, it's tempting. I'd maybe get some shares later, when the selling is done. Might be done for now, actually. GOOG was at 446 intra-day.

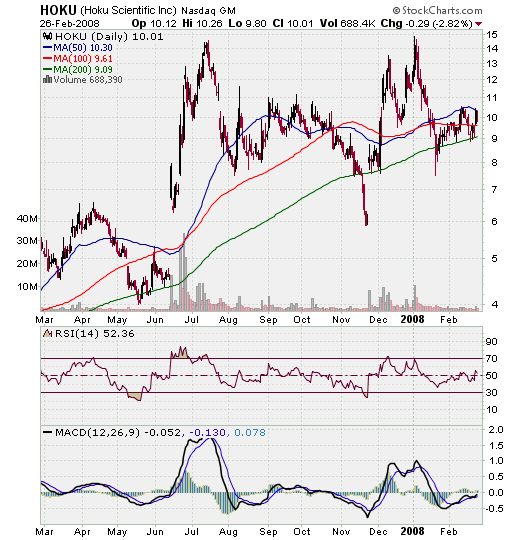

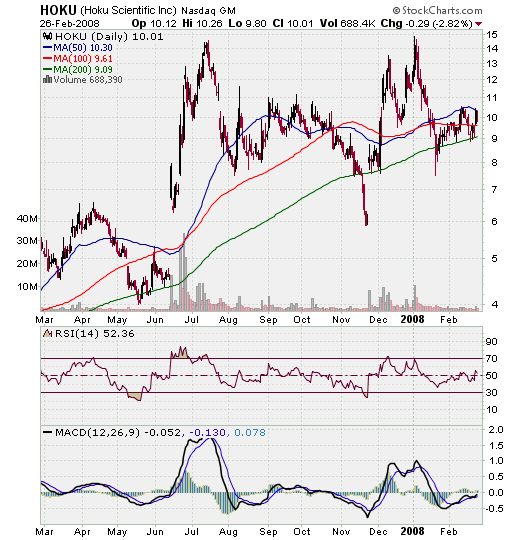

Hoku Scientific (HOKU) I already have. Like the company, though risk comes with this. They still need to secure financing for the polysilicon plant in Idaho. Sanyo and Suntech Power are two of the big boys who are betting on Hoku. If the company comes through, there is $10 billion in contracts waiting.

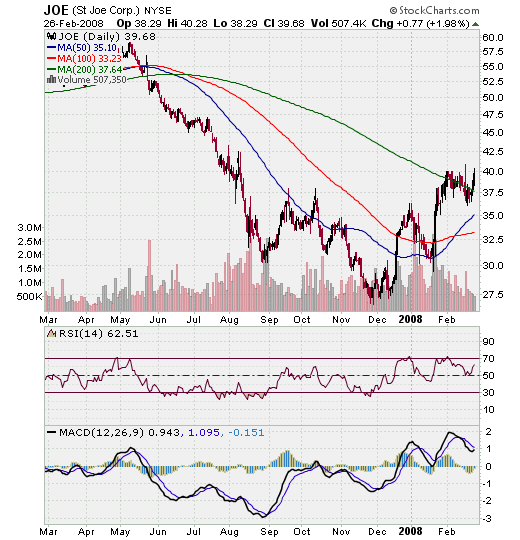

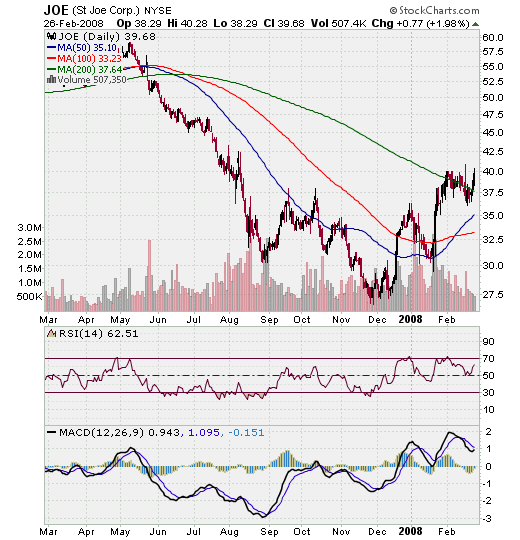

Never heard of St. Joe Corp. (JOE). Gotta do homework.

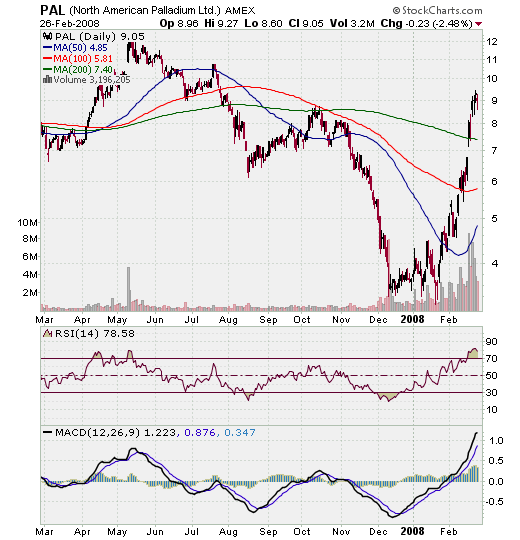

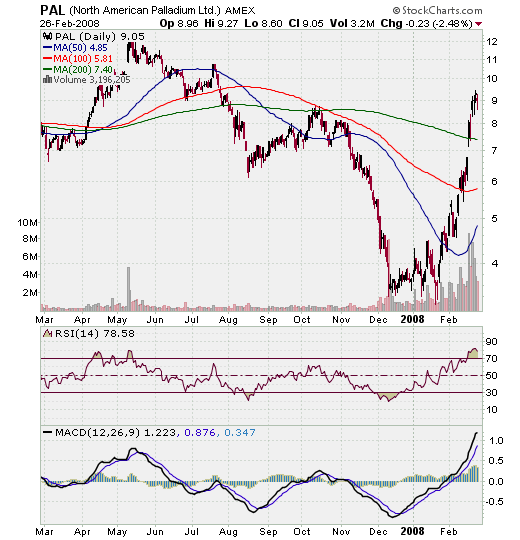

Metallurgic stocks are hot right now, and I know nothing about them. But metals and other commodities are in demand because of the modernization in China, India and Brazil. North American Palladium (PAL) has run from 3.50 to 9 ... incredible gap-ups in the past month. Careful here. The profit-taking will be immense until the next catalyst/contract. Looking forward to doing some homework here.

Awesome maaan. I had to look these up. Some I never knew about before.

Citigroup (C) is very tempting. They have healthy exposure in China, was one of the first major financial institutions to get really embedded in the new economy there. Ups and downs because of the mortgage mess, but there's more upside than downside from here, I think. I kinda expect at least one more downturn related to the mortgage crisis, but that's bearable.

Crocs (CROX) I have to confess I gave up on when I lost a big profit. I wear their sandals, believe in the product. But it went from 40 to 75 and back to below 40. I think it's still a good company but the slowing growth means 75 probably ain't gonna happen with consumer spending tailing off. Maybe 50. That would be a nice profit. I just won't go near it.

I have no idea what EMCOR Group (EME) does, but the stock is on a big roll. It gapped up last week from 22 to 24 and is now at 25.36. Need to do homework on this puppy.

E-Trade (ETFC) I like as an online broker, but there are some serious, ongoing issues in regard to loans. The brokerage is just a small part of the company now so I wonder what the future holds when people make less money (economy, inflation) and default on their loans. When ETFC went below 3, that was just paranoia, though. Doubling to 5 between January and February was the top, I'm guessing. It's gonna take a whole lot to move the stock above 6. I hope it happens.

General Electric (GE) is a classic blue-chip, but it's so huge, where's the growth going to come from? It's a safe stock in this bear market, a good addition to the portfolio.

Google (GOOG) will be back. Maybe not to 750 (last November) right away, but at 464 today, it's tempting. I'd maybe get some shares later, when the selling is done. Might be done for now, actually. GOOG was at 446 intra-day.

Hoku Scientific (HOKU) I already have. Like the company, though risk comes with this. They still need to secure financing for the polysilicon plant in Idaho. Sanyo and Suntech Power are two of the big boys who are betting on Hoku. If the company comes through, there is $10 billion in contracts waiting.

Never heard of St. Joe Corp. (JOE). Gotta do homework.

Metallurgic stocks are hot right now, and I know nothing about them. But metals and other commodities are in demand because of the modernization in China, India and Brazil. North American Palladium (PAL) has run from 3.50 to 9 ... incredible gap-ups in the past month. Careful here. The profit-taking will be immense until the next catalyst/contract. Looking forward to doing some homework here.

SBUX, GOOG, IBM in play

Starbucks shut down for the day, Google is at a one-year low and IBM rocked like an old-school classic.

Jeff Macke is bullish on SBUX. I don't know if it's worth holding long term with competition from McDonald's and Dunkin Donuts.

Erick Schonfield questions the paranoia of GOOG sellers. The stock fell to an intra-day low of 446 before settling at 464, down 5%.

In this bear market, IBM's fantastical, cloud nineish forecast stands out. I may have a crush on Big Blue. I listed it today at No. 6 on my Top 25.

Jeff Macke is bullish on SBUX. I don't know if it's worth holding long term with competition from McDonald's and Dunkin Donuts.

Erick Schonfield questions the paranoia of GOOG sellers. The stock fell to an intra-day low of 446 before settling at 464, down 5%.

In this bear market, IBM's fantastical, cloud nineish forecast stands out. I may have a crush on Big Blue. I listed it today at No. 6 on my Top 25.

Monday, February 25, 2008

Apple beaten to a pulp

AAPL has been blown to smithereens. Larry Dignan says the angst is overdone. I hope he's right. I'm not long AAPL, but I'm a fan.

Hoku secures more financing

Hoku Scientific took another step toward completing the polysilicon plant in Idaho by raising $25 million. That explains today's jump (more than 10%), but issuing stock isn't always good for shareholders in the short term. HOKU, though, is not the normal stock and this is not an old company diluting its share price.

It's a good move, and the string of positive action by management is promising for longs. I picked up some shares near the close (10.20). Not cheap. It was below 9 last week. But today's volume was quite large and the stock, still below its 50-day SMA, is compelling long term.

It's a good move, and the string of positive action by management is promising for longs. I picked up some shares near the close (10.20). Not cheap. It was below 9 last week. But today's volume was quite large and the stock, still below its 50-day SMA, is compelling long term.

HOKU, YGE have happy feet

If this truly is the year of solar, today may have been the last chance to get Hoku Scientific below 10 and Yingli Green Energy below 19. Credit disaster or not, oil is still going through the roof via demand, political maneuvering or something else. Gasoline is something that the big fish will always use to swallow us little fish. Not that I'm long, as I probably should have been, CNOOC or PetroChina or even Flowserve to begin with.

Solar won't be The Answer. But it will be a key slice of the pie. Hoku leaped over 10 again today and is pushing to its intra-day high at 10.20 right now. I saw it drift below 9 last week and waited for a chance to get shares at 8.50 or even 8 flat. Now that it's up more than 10% for the day, I can only wait.

Waiting is something I've done on YGE, which dropped like a dead carcass to the bottom of the ocean after I bought shares above 24. YGE is up from its recent low near 18 and is holding at 19.38 right now. I don't trust this market at all and there's no point in assuming anything. But the solar sector is mixed today, and it seems short-term traders are betting on small caps like Hoku and Yingli.

Solar won't be The Answer. But it will be a key slice of the pie. Hoku leaped over 10 again today and is pushing to its intra-day high at 10.20 right now. I saw it drift below 9 last week and waited for a chance to get shares at 8.50 or even 8 flat. Now that it's up more than 10% for the day, I can only wait.

Waiting is something I've done on YGE, which dropped like a dead carcass to the bottom of the ocean after I bought shares above 24. YGE is up from its recent low near 18 and is holding at 19.38 right now. I don't trust this market at all and there's no point in assuming anything. But the solar sector is mixed today, and it seems short-term traders are betting on small caps like Hoku and Yingli.

Thursday, February 21, 2008

HOKU bucks trend

How did Hoku Scientific buck the declining solar sector today? HOKU up 4.3% to 9.59 while the sector fell off a cliff. Shares were below 9 in the final hour, but big buying in the last few minutes pushed it up. The news? There is no news.

I almost bought some yesterday, but decided to wait for 8.50 or even 8.00. I'll be patient here. HOKU will be a winner in 2009. No price target here, but that's my expectation.

I almost bought some yesterday, but decided to wait for 8.50 or even 8.00. I'll be patient here. HOKU will be a winner in 2009. No price target here, but that's my expectation.

Tuesday, February 19, 2008

STP has solar longs on edge

Yingli took the plunge with a sub-par earnings report on Friday. On Wednesday morning, Suntech Power reports. Depending on who you believe, STP will disappoint in the near-term and bring the solar sector down. That would be good news for folks who want to go long FSLR at a cheaper price. But that would also be bad news for those of us still holding YGE.

Monday, February 18, 2008

Behind ETFC's loyalists, some brutal numbers

I've thought of ETFC below $4 as preposterous. When E-Trade's stock fell below 3 in the recent swoon, yoikes. Now that ETFC is above 5, there are questions galore. Does the company deserve the benefit of the doubt? Should ETFC climb back into the 20s now that the Fed is slashing rates?

Or, as Richard Shinnick writes, E-Trade's crisis has almost nothing to do with the brokerage arm (which has its fervent loyalists) and almost everything to do with loans. Shinnick breaks down the basic numbers and provides a stark contrast to the ETFC bulls who haven't delved very deeply into the murky waters of subprime sludge.

Even with this, the overriding question is, who will eventually take over E-Trade?

Or, as Richard Shinnick writes, E-Trade's crisis has almost nothing to do with the brokerage arm (which has its fervent loyalists) and almost everything to do with loans. Shinnick breaks down the basic numbers and provides a stark contrast to the ETFC bulls who haven't delved very deeply into the murky waters of subprime sludge.

Even with this, the overriding question is, who will eventually take over E-Trade?

Friday, February 15, 2008

Pupule's week in review: Oww!

Sold Yahoo and Disney for decent profits of 5.3% and 4.6%. A decent start, even if it required holding through almost two weeks of soap-opera wackiness on Yahoo's part.

Closed the week on a bummer, though, after mistiming Yingli. Down 12.7% in just 24 hours. Even though my flaky theories about the end of the week have some credence, I went against them. My theories?

1. Earnings reports released late in the week (Thursday or Friday) are usually bearish and negative and plainly suck. (And earnings early in the week are usually bullish, i.e. FSLR.)

2. A buy on Thursday is no good most times, and a buy on Friday morning is horrible.

3. The best time to buy is often at the closing bell on Friday.

All these have been fairly true, I've found. But I still bought Yingli Green Energy on Thursday at 24.80. Near its recent high (25.50). It sank the rest of the day, but finished at 24.88. Earnings report before the opening bell today was good, but didn't beat expectations. The run was done (18 to 25 in one week) and sellers stormed the castle. By the end of the day, YGE was below 22 and I wondered ... why am I still trading on a whim? I put my homework and caution into DIS and YHOO. With YGE, I did not respect the recent movement in the stock. I assumed. And you know what happens to people who assume. Yep, they are ASSes. I'm an ass.

So, I'm holding the bag on YGE, promising myself (again) to never buy a stock going into earnings. It's almost like former UH football coach Dick Tomey's philosophy about passing. He often said that three things happen when you throw, and two are bad: 1. completion, 2. incompletion, 3. interception.

Earnings? 1. The Co beats estimates and raises guidance, 2. beats estimates, neutral guidance, 3. meets estimates, but doesn't surpass. The latter two mean the stock plummets in this bearish market. That's what happened to YGE. And if I had waited until the close, I could've gotten shares at 21.65, if I wanted.

Some YGE enthusiasts would probably average down here, but I'm against that method. There's too much momentum, too many bears in the stock. It takes so little to beat YGE down and takes a lot to bring it back up. If the market retests recent lows, YGE will sink, perhaps all the way to 18 as it did last month.

Volume today was monstrous, the most ever in YGE. Gap down, 11 million shares traded... completely bearish. I would've been better off sleeping through the market yesterday and today.

Closed the week on a bummer, though, after mistiming Yingli. Down 12.7% in just 24 hours. Even though my flaky theories about the end of the week have some credence, I went against them. My theories?

1. Earnings reports released late in the week (Thursday or Friday) are usually bearish and negative and plainly suck. (And earnings early in the week are usually bullish, i.e. FSLR.)

2. A buy on Thursday is no good most times, and a buy on Friday morning is horrible.

3. The best time to buy is often at the closing bell on Friday.

All these have been fairly true, I've found. But I still bought Yingli Green Energy on Thursday at 24.80. Near its recent high (25.50). It sank the rest of the day, but finished at 24.88. Earnings report before the opening bell today was good, but didn't beat expectations. The run was done (18 to 25 in one week) and sellers stormed the castle. By the end of the day, YGE was below 22 and I wondered ... why am I still trading on a whim? I put my homework and caution into DIS and YHOO. With YGE, I did not respect the recent movement in the stock. I assumed. And you know what happens to people who assume. Yep, they are ASSes. I'm an ass.

So, I'm holding the bag on YGE, promising myself (again) to never buy a stock going into earnings. It's almost like former UH football coach Dick Tomey's philosophy about passing. He often said that three things happen when you throw, and two are bad: 1. completion, 2. incompletion, 3. interception.

Earnings? 1. The Co beats estimates and raises guidance, 2. beats estimates, neutral guidance, 3. meets estimates, but doesn't surpass. The latter two mean the stock plummets in this bearish market. That's what happened to YGE. And if I had waited until the close, I could've gotten shares at 21.65, if I wanted.

Some YGE enthusiasts would probably average down here, but I'm against that method. There's too much momentum, too many bears in the stock. It takes so little to beat YGE down and takes a lot to bring it back up. If the market retests recent lows, YGE will sink, perhaps all the way to 18 as it did last month.

Volume today was monstrous, the most ever in YGE. Gap down, 11 million shares traded... completely bearish. I would've been better off sleeping through the market yesterday and today.

Two wrongs don't make a Yang right

Roger Ehrenberg explains why a Yahoo-News Corp. deal would suck royally for YHOO shareholders. Frankly, I wouldn't mind having YHOO shares, even though I emptied out yesterday with a small profit (5%). But Ehrenberg has valid points, and clearly believes that Microsoft will swoop in via YHOO longs.

I can't help thinking that Jerry Yang is putting forth a front about fighting for Yahoo's independence. I can't help thinking that he has to do this to get shareholders their best price point from MSFT. Maybe $34. Maybe $35. And I can't help but think that he has to save face with his underling Yahoos in light of recent layoffs. I don't think he wants the ship to go down, and that's what will eventually happen if MSFT doesn't take over. It could happen even if MSFT takes over.

What I'm saying is, Google is king of the world.

I can't help thinking that Jerry Yang is putting forth a front about fighting for Yahoo's independence. I can't help thinking that he has to do this to get shareholders their best price point from MSFT. Maybe $34. Maybe $35. And I can't help but think that he has to save face with his underling Yahoos in light of recent layoffs. I don't think he wants the ship to go down, and that's what will eventually happen if MSFT doesn't take over. It could happen even if MSFT takes over.

What I'm saying is, Google is king of the world.

Yingli slides with sector, but guidance strong

Yingli Green Energy beaten down with many sticks this morning. Understandable after running from 18 last week to 25-plus yesterday. Now trading just below 23, but the rest of the solar sector is in the red. Options expiry could peg shares of YGE to 22.50, but the stock may not stay there for long.

The conference call, loaded with large numbers to the upside, revealed that 70% of polysilicon needs are secure, gross margin (Q4) increased 24%, and '08 gross margins will be close to '07 gross margins. Plus, polysilicon costs continue to be lowest in the industry, and taxes will decline in '08, as well.

Guidance is bullish, which means YGE will rally when the market reverses. Or will the market retest recent lows first? Still holding my YGE shares here.

The conference call, loaded with large numbers to the upside, revealed that 70% of polysilicon needs are secure, gross margin (Q4) increased 24%, and '08 gross margins will be close to '07 gross margins. Plus, polysilicon costs continue to be lowest in the industry, and taxes will decline in '08, as well.

Guidance is bullish, which means YGE will rally when the market reverses. Or will the market retest recent lows first? Still holding my YGE shares here.

Yahoo board splits into camps

Oh, the civil war within Yahoo is fierce. I'm glad to be out of YHOO, but the drama ... I am moth to light on this soap opera.

>> New York Post: Board Bucks Jerry

>> New York Post: Board Bucks Jerry

Le Drama Dendreon

My old stock-I-love-to-hate, DNDN, spiked up 8.6% to 6.17 yesterday on news about ... well, color it however you like. If you believe in Provenge, Dendreon's prostate cancer treatment, it's all good. But if you think the news is overdone, you probably agree with Forbes' Ruthie Ackerman

Canaccord Adams analyst Joseph Pantginis said Thursday’s data supports the approach the biotechs’ have been taking in the immunotherapy space, but isn’t necessarily specific to Dendreon.

Pantginis believes the competition from the GVAX prostrate cancer vaccine developed by Cell Genesys (nasdaq: CEGE - news - people ) will not allow Dendreon to get a sizable market share. If both drugs get approved, Pantginis says that GVAX will win out because of logistics, cost and efficacy.

I'm not running, walking or jumping into this inferno. As much as I wanted (and still want) to see Provenge give victims a chance to live longer, to have more hope, the manipulation of the stock was a hard lesson to learn about the whims of the FDA and the street. DNDN may run big on the news, or sink on the pale comparison to GVAX. Either way, there are a lot better stocks — more stable, more growth with less drama — and I'm going to be there rather than in Dendreon.

Canaccord Adams analyst Joseph Pantginis said Thursday’s data supports the approach the biotechs’ have been taking in the immunotherapy space, but isn’t necessarily specific to Dendreon.

Pantginis believes the competition from the GVAX prostrate cancer vaccine developed by Cell Genesys (nasdaq: CEGE - news - people ) will not allow Dendreon to get a sizable market share. If both drugs get approved, Pantginis says that GVAX will win out because of logistics, cost and efficacy.

I'm not running, walking or jumping into this inferno. As much as I wanted (and still want) to see Provenge give victims a chance to live longer, to have more hope, the manipulation of the stock was a hard lesson to learn about the whims of the FDA and the street. DNDN may run big on the news, or sink on the pale comparison to GVAX. Either way, there are a lot better stocks — more stable, more growth with less drama — and I'm going to be there rather than in Dendreon.

Thursday, February 14, 2008

Banking on solar: YGE

This is my second go-round with Yingli Green Energy. It's not a best-of-breed like First Solar, but YGE's earnings are out tomorrow and for some very simple(ton) reasons, I think it will be spectacular.

Bot YGE @ 24.80

I got shares on what I thought would be a minor pullback in the solar sector. But it dived with the sector and I should've had stops in. When I fell asleep (at about 5:30 a.m. Hawaii time), YGE hit its low for the day at 23.11. By the close, it was back up to 24.88. A lot of optimists on this stock, unlike FSLR, which sold off the day before its earnings report.

Suntech Power reports on Wednesday. Watching for a great entry point on STP, which closed at 50.49 (-2.30, 4.3%) today. STP is 44% off its high of 90 in just six weeks. HOKU was tempting, too, but I still have 9 as my desired entry point. HOKU fell more than 2% to 9.95. I'll wait and watch. I think 9 is the new support since Sanyo extended its contract from seven to 10 years. Instead of trading between 6 and 14, the new range may be 9 and ... who knows?

Bot YGE @ 24.80

I got shares on what I thought would be a minor pullback in the solar sector. But it dived with the sector and I should've had stops in. When I fell asleep (at about 5:30 a.m. Hawaii time), YGE hit its low for the day at 23.11. By the close, it was back up to 24.88. A lot of optimists on this stock, unlike FSLR, which sold off the day before its earnings report.

Suntech Power reports on Wednesday. Watching for a great entry point on STP, which closed at 50.49 (-2.30, 4.3%) today. STP is 44% off its high of 90 in just six weeks. HOKU was tempting, too, but I still have 9 as my desired entry point. HOKU fell more than 2% to 9.95. I'll wait and watch. I think 9 is the new support since Sanyo extended its contract from seven to 10 years. Instead of trading between 6 and 14, the new range may be 9 and ... who knows?

Goodbye Mickey, Yahooligans

Took my Disney and Yahoo shares off the table early in the day. (Before I fell asleep for the final five-plus hours of the session.)

Sold YHOO @ 29.90

net +1.51 (+5.3%)

Sold DIS @ 32.65

net +1.45 (+4.6%)

Wasn't happy about losing some gains on Disney at the open, but it was the right move as the market swooned. Dow down 171 (1.4%) and Nasdaq down 41 (1.7.%). Both held up rather well: YHOO closed at 29.96. DIS closed at 32.30. Still like them as trading vehicles. Just not in this environment. Market was due for a selloff.

Sold YHOO @ 29.90

net +1.51 (+5.3%)

Sold DIS @ 32.65

net +1.45 (+4.6%)

Wasn't happy about losing some gains on Disney at the open, but it was the right move as the market swooned. Dow down 171 (1.4%) and Nasdaq down 41 (1.7.%). Both held up rather well: YHOO closed at 29.96. DIS closed at 32.30. Still like them as trading vehicles. Just not in this environment. Market was due for a selloff.

Wednesday, February 13, 2008

Yahoo-MySpace makes little sense

A logical breakdown of the Yahoo-News Corp. talks (et al MySpace) by Hammerin' Hank Blodget.

>> Yahoo-MySpace: A Microsoft Alternative, But A Bad Deal

Tough to argue with his line of reasoning. I'm still holding my YHOO shares ... but antsy for Jerry Yang to do something already.

>> Yahoo-MySpace: A Microsoft Alternative, But A Bad Deal

Tough to argue with his line of reasoning. I'm still holding my YHOO shares ... but antsy for Jerry Yang to do something already.

Suntech to knock it out of the park?

Though I have a soft spot for Hoku Scientific (as a local company), Suntech Power also has my attention. Even with today's insane surge (15%), STP is way, way, way off its high of 90. At 53, STP is off it's high by 41%. Suntech reports next week (Feb. 20). The stock is above its 200-day SMA (47), below its 100-day SMA (60). Volume was huge today. The stock ain't cheap, but it's still a reasonable price. Might walk out of DIS to get some STP.

Holy Sol!

Holy smokin' sun. First Solar up to 230 in after-hours trading. That's a gain of $54 since yesterday's close. The circus sideshow is alive and well again. FSLR. BIDU. Ka-Boom!

More solars on fire (AH numbers):

ENER 28.28 +2.45 (+9.5%)

ESLR 11.36 +1.25 (+12.4%)

HOKU 10.20 +0.21 (+2.1%)

SPWR 78.51 +7.21 (+10.1%)

STP 53.01 +7.09 (+15.4%)

YGE 24.60 +3.85 (+18.5%)

I've liked Hoku and Yingli in the past, but my toes are in cement (DIS, YHOO) right now and I find it difficult to get them toes out. Watching FSLR today was not quite as fun or profitable as being in. Do I wish I'd jumped in at 207 or 210? Of course. I deserve a chance to dance the Snoopy dance once in awhile.

More solars on fire (AH numbers):

ENER 28.28 +2.45 (+9.5%)

ESLR 11.36 +1.25 (+12.4%)

HOKU 10.20 +0.21 (+2.1%)

SPWR 78.51 +7.21 (+10.1%)

STP 53.01 +7.09 (+15.4%)

YGE 24.60 +3.85 (+18.5%)

I've liked Hoku and Yingli in the past, but my toes are in cement (DIS, YHOO) right now and I find it difficult to get them toes out. Watching FSLR today was not quite as fun or profitable as being in. Do I wish I'd jumped in at 207 or 210? Of course. I deserve a chance to dance the Snoopy dance once in awhile.

Baidu rockin' the free world

Baidu was a lovely bargain in the 220s and 230s. In fact, the low of 223 was only a week ago. Today, BIDU was available at 238 early on. But with a robust earnings report after hours, the stock rocketed to 293. Because the stock had been beaten to a pulp, even in the 280s and 290s, BIDU is well below its 50- and 100-day SMAs. (And way over the 200 SMA of 254.)

Buy BIDU here? Possibly. Or Google, which has zoomed in tandem over 540.

Buy BIDU here? Possibly. Or Google, which has zoomed in tandem over 540.

Compass to profits

Compass Minerals, First Solar ... who is going to short companies that shred earnings estimates? CMP has already run from 46 to 53 in two days, but is worth watching on an eventual pullback. Ivanoff at Trading Goddess passed the info on.

In the past 10 minutes, CMP has gone from 52 to nearly 54. The float is just 31 million shares, P/E is 30, forward P/E is 18 and even before Q4 earnings, earnings and revenue growth were stellar. Looks like this could trade like a Potash or Spartan Motors. Potash is my No. 1 stock pick. Spartan ran huge last year before going ker-plunk. I'm watching CMP; it's too late to dip in at these lofty levels. When the momo cools off, definitely worth a closer look.

In the past 10 minutes, CMP has gone from 52 to nearly 54. The float is just 31 million shares, P/E is 30, forward P/E is 18 and even before Q4 earnings, earnings and revenue growth were stellar. Looks like this could trade like a Potash or Spartan Motors. Potash is my No. 1 stock pick. Spartan ran huge last year before going ker-plunk. I'm watching CMP; it's too late to dip in at these lofty levels. When the momo cools off, definitely worth a closer look.

So hot, don't get burned

First Solar's Q4 earnings numbers have main street doing the Snoopy dance. FSLR hit 218 in premarket, sold down to 211, and is now back to 215. It closed yesterday at 175. Is FSLR hot enough to keep bursting higher as a day trade today?

I stayed out of FSLR before earnings. My experience was definite Pavlonian effect. In the past year, FSLR missed only once. I held the bag on that one and sold at a loss. That was more than 110 dollars ago. Doh. FSLR could work as a short-term trade, but as an long-term entry point, this is way out of line.

I stayed out of FSLR before earnings. My experience was definite Pavlonian effect. In the past year, FSLR missed only once. I held the bag on that one and sold at a loss. That was more than 110 dollars ago. Doh. FSLR could work as a short-term trade, but as an long-term entry point, this is way out of line.

Microsoft still holds trump card

Michael Arrington (Tech Crunch) says a News Corp.-Yahoo spooning would not be so smooth.

One major snag - it is widely believed that, even with a News Corp. deal, Yahoo would need to outsource search marketing to Google to make the numbers work. While Google is likely happy to do that deal, it’s unlikely U.S. regulatory agencies would approve it...

One major snag - it is widely believed that, even with a News Corp. deal, Yahoo would need to outsource search marketing to Google to make the numbers work. While Google is likely happy to do that deal, it’s unlikely U.S. regulatory agencies would approve it...

Tuesday, February 12, 2008

Hold yer MicroHoo horses

SAI's Peter Kafka writes that a News Corp.-Yahoo agreement could put the kabosh on Microsoft's takeover plan. He says News Corp. wouldn't buy Yahoo, but fork over online pieces like MySpace in exchange for a significant equity stake.

>> Yahoo-News Corp Still Talking, Deal Still Possible

Who knows what will come of it. The soap opera never ends.

>> Yahoo-News Corp Still Talking, Deal Still Possible

Who knows what will come of it. The soap opera never ends.

Top 25: #1 Potash

Top 25: #3 Google

Top 25: #4 MasterCard

Top 25: #5 McDonald's

Top 25: #6 China Mobile

Top 25: #7 PetroChina

Top 25: #8 First Solar

Top 25: #9 Suntech Power

Top 25: #10 Disney

Yesterday felt and looked more like a temporary breather for DIS after a healthy run-up. Now approaching its 100-day SMA, Disney had a great Q4, but the lack of optimistic guidance has put a lid, perhaps, on the stock. I like the revenues from the cruise line (85% sold out), but I won't be adding any more DIS at this level. I got in at 31.20 and watching closely.

Top 25: #11 Nintendo

At 55.40, NTDOY.PK is still somewhat cheap. I don't see a bounce anytime soon, however. The stock tends to go limp in February and March, understandably, while holiday shopping season is long gone. Still, it's a stellar company with a killer app product. Love the Wii!

Top 25: #12 Apple

Top 25: #13 Research in Motion

Top 25: #14 Flowserve

Top 25: #15 Goldman Sachs

Top 25: #16 Chipotle Mexican Grill

Top 25: #17 Focus Media

Top 25: #18 CNOOC Ltd.

Top 25: #19 lululemon athletica

Yep, lululemon yoga pants look great on everyone. They look great on Eva Longoria.

Three up days for LULU, rising volume, but nothing spectacular. I once rode LULU from 38 to 60 back down to 42. Yeah. It sucked. lululemon, however, does not. I still maintain that women 18-35 who work out hard and do yoga are going to keep buying $100 yoga pants that show off the results of all that sweat. True.

Three up days for LULU, rising volume, but nothing spectacular. I once rode LULU from 38 to 60 back down to 42. Yeah. It sucked. lululemon, however, does not. I still maintain that women 18-35 who work out hard and do yoga are going to keep buying $100 yoga pants that show off the results of all that sweat. True.

Hawaii's big venture

Jane Wells of CNBC is pretty damned funny, and she even brings her sense of humor to the islands. I live here but I didn't know about the extreme tax-credit deal.

Top 25: #20 Amazon

Top 25: #21 Foster Wheeler

Top 25: #22 Baidu

Up for three days in a row, but declining volume is a warning sign to the overly bullish. I really like Baidu the company, the intensity and ferocity it has to defend its turf against all Western invaders — that's their mentality and if you don't agree go check out the many Baidu TV commercials on YouTube. BIDU is a bargain right now, but I'll wait first.

Top 25: #23 Nike

Top 25: #24 Microsoft

The dangers of an unknown Apple

Daniel Agramonte makes some key points about Apple as a company, and many of his observations are widely held. I wish I'd noticed a little more when AAPL fell from 200 plus; I didn't sell until 135 and lost profits in the one stock I considered unbeatable. Lesson well learned.

Yes, AAPL has rallied since hitting 122 last week. It could run higher, I know. But I'm still wary. No catalyst is in sight, and it'll be difficult for me to step into any stock without a big event/product. There is no new killer app, no new iPhone effect in sight. Yet.

Yes, AAPL has rallied since hitting 122 last week. It could run higher, I know. But I'm still wary. No catalyst is in sight, and it'll be difficult for me to step into any stock without a big event/product. There is no new killer app, no new iPhone effect in sight. Yet.

Monday, February 11, 2008

Longshots: Hoku Scientific

My favorite of the 3 Longshots is Hoku Scientific. How can anyone shun the $10 billion in contracts? Or the recent extension to the Sanyo deal? Conversely, it's impossible to wonder if the Idaho plant will be ready on time. My gut says HOKU will come through, but experience tells me wait for a great price. Today's run to 10.11 puts the stock near its 50-day SMA. There's still quite a bit of time before the plant deadline is here, and I expect HOKU to fluctuate up and down. If it can drop back to its 200-day SMA (8.85), I'm in.

Longshots: E-Trade

I was stunned when ETFC fell below 4 in November, and the plunge under 3 last month was even more insane. Now that the Fed rate has been slashed and the worst seems to be behind E-Trade, the run to previous levels is no shock. At 4.97, ETFC is still below its 100-day SMA, not a bad price. But I prefer sub-4 as a suitable entry point.

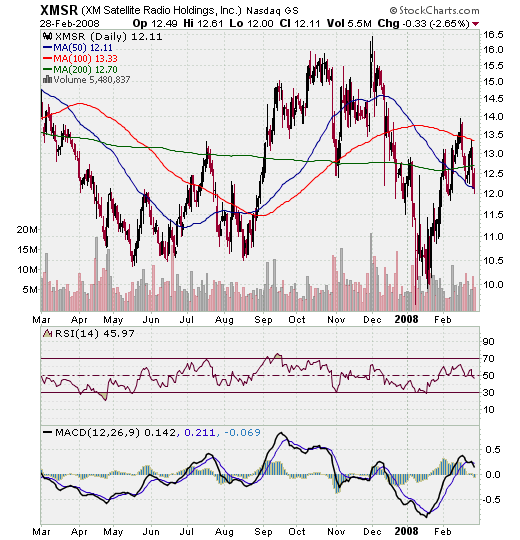

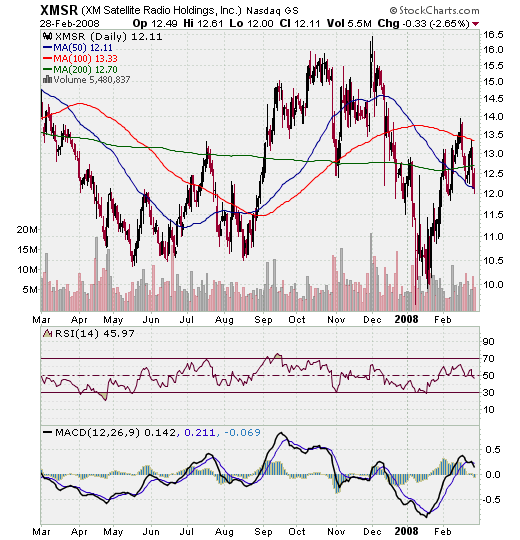

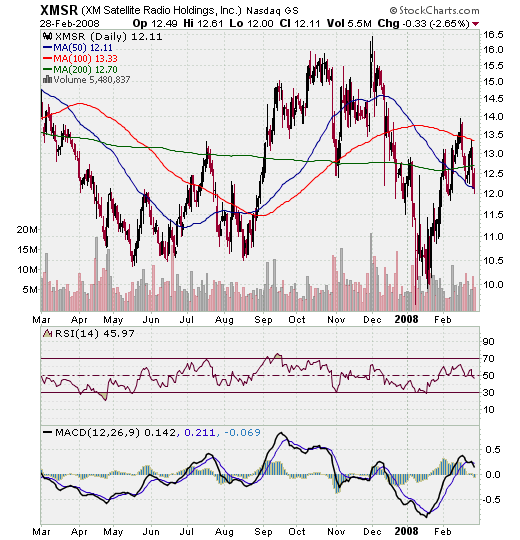

Longshots: XM Satellite Radio

My pal Kyle loves XM Satellite Radio so much — particularly the MLB coverage — that he went long the stock a few weeks back. XMSR fell 3% today to 12.72, still a healthy gain in that time. Volume was miniscule on today's pullback. Was it a healthy breather before another run up? Or is XMSR tapped out and ready to sell off again? I'm not an XM fan, but if I were, I'd wait 'til it drops back to its 200-day SMA (12.61 and no higher) before considering.

A boost for the Yahoo troops

Gotta hand it to Yahoo and CEO Jerry Yang. As Henry Blodget notes, Yang's newest e-mail to employees spells out the horizon (somewhat) and drives a flag into the company's turf. Cemented, perhaps. Or maybe just temporary, until Microsoft hikes that takeover price to $35 per share.

>> Grading Jerry's Latest Email to the Yahoo Troops: "A-"

The e-mail alone may have been the best reason why YHOO shares bumped over 30 after hours. It certainly didn't hurt YHOO longs that Steve Ballmer swore over his pirate ancestors' graves that he will continue to push for a takeover. OK, I made up the pirate stuff. But he's just as carnivorous.

>> Grading Jerry's Latest Email to the Yahoo Troops: "A-"

The e-mail alone may have been the best reason why YHOO shares bumped over 30 after hours. It certainly didn't hurt YHOO longs that Steve Ballmer swore over his pirate ancestors' graves that he will continue to push for a takeover. OK, I made up the pirate stuff. But he's just as carnivorous.

HOKU passes 10

I really wanted to scoop up some HOKU below $9. The recent extension of the contract with Sanyo was a good boost. But after closing at 9.37 on Friday, Hoku soared to 10.30 today. Currently at 10.07. Looks like 9 flat is a long ways off, but I'll be waiting patiently.

Sunny day for solar stocks

Alternative energy is up big today while China oil is down significantly. Why? Does it matter? Crude oil fluctuates and solar stocks usually respond, but not always. I think what moved First Solar 8% to 187 (higher earlier) is the upcoming earnings report for Wednesday. Zack's thinks FSLR will surprise.

>> Zacks Earnings Preview

I'm not exactly eager to walk into FSLR before the earnings report. The one time I did was the only time in the past year FSLR missed estimates. I'd just as soon wait for HOKU to get below 9, which will take awhile since it zoomed past 10 (again) today.

>> Zacks Earnings Preview

I'm not exactly eager to walk into FSLR before the earnings report. The one time I did was the only time in the past year FSLR missed estimates. I'd just as soon wait for HOKU to get below 9, which will take awhile since it zoomed past 10 (again) today.

Stimulus package good for Disney?

James Alutcher thinks the Fed's stimulus package will help Disney cruises. The more kids, the bigger your check from the Fed. I wonder if he'll be right. In any event, DIS is down 23¢ (-0.6%) to 31.89 on very low volume today. A nice pause.

>> Disney benefits from stimulus?

>> Disney benefits from stimulus?

MSFT offered $35?

So, Microsoft's previous offer for Yahoo was $35. Or so says Henry Blodget. This would explain why YHOO is up more than 2% so far ($29.82). The Nasdaq is up 13 points (0.56%) and 19 of my Top 25 are in the green. I expected Yahoo to be down today after its board rejected MSFT's offer and countered with a $40 demand.

>> Yahoo's "AOL Talks"--More Smart Smoke From Yahoo's Advisors

The "smokescreeen" talk may or may not be helping. Something's helping. MSFT is down 1.6% to 28.08.

>> Yahoo's "AOL Talks"--More Smart Smoke From Yahoo's Advisors

The "smokescreeen" talk may or may not be helping. Something's helping. MSFT is down 1.6% to 28.08.

Saturday, February 9, 2008

Yahoo counters with $40 demand

It's a big-time poker game and Yahoo has responded to Microsoft's move. Silicon Alley Insider's Henry Blodget has another astute analysis.

>> How Will MSFT Respond To YHOO's Counter?

Our current guess, therefore, is that Microsoft will respond to Yahoo's counter-offer by trying to win over Yahoo's big shareholders and biding its time.

Paul Kedrowsky, however, has a higher value on Yahoo than Blodget does.

>> Yahoo: Rejecting Microsoft; Entering the Bargaining Stage

Is Yahoo right to bargain? Sure. Most sum-of-parts analysis of Yahoo -- my own included -- puts Yahoo's breakup value somewhere between $35 and $42, depending on how much you want to trust the valuations of Alibaba and Yahoo Japan. That's materially over Microsoft's offer, doubly so if you consider that Microsoft has a legitimate strategic interest in owning Yahoo, making this more than a purely valuation-driven exercise.

>> How Will MSFT Respond To YHOO's Counter?

Our current guess, therefore, is that Microsoft will respond to Yahoo's counter-offer by trying to win over Yahoo's big shareholders and biding its time.

Paul Kedrowsky, however, has a higher value on Yahoo than Blodget does.

>> Yahoo: Rejecting Microsoft; Entering the Bargaining Stage

Is Yahoo right to bargain? Sure. Most sum-of-parts analysis of Yahoo -- my own included -- puts Yahoo's breakup value somewhere between $35 and $42, depending on how much you want to trust the valuations of Alibaba and Yahoo Japan. That's materially over Microsoft's offer, doubly so if you consider that Microsoft has a legitimate strategic interest in owning Yahoo, making this more than a purely valuation-driven exercise.

Friday, February 8, 2008

Disney closes out a strong week

I am a friggin' Hannah Montana fan in the best way right now. Instead of faltering today, shares of Disney finished up more than 1% to 32.12 — quite a bump from Tuesday's close of 30.07. I got in after hours that day at 31.20, tickled by the company's resilience and breadth of success from Hannah Montana's concert film to theme cruises.

Disclosure: I never wanted to to go to Disneyland, but I wound up there once. Still have no desire to go back. I'll probably never go on one of those hugely popular family theme cruises. I don't even want to see Hannah Montana, even with a free ticket.

That said, I'm still holding my DIS shares even though Corey Rosenbloom expects a pullback. He's obviously a very astute observer, but the strength of Disney makes it a happy hold. At least until the next market panic.

Disclosure: I never wanted to to go to Disneyland, but I wound up there once. Still have no desire to go back. I'll probably never go on one of those hugely popular family theme cruises. I don't even want to see Hannah Montana, even with a free ticket.

That said, I'm still holding my DIS shares even though Corey Rosenbloom expects a pullback. He's obviously a very astute observer, but the strength of Disney makes it a happy hold. At least until the next market panic.

Insana's insane request: Fed rate at 1%

Ron Insana used to wear a toupee. Wig. Hairpiece. But now he runs a hedge fund, looks sharp without the fake hair, and tells CNBC (Dennis Neill and Melissa Lee) that we're in for a potentially hazardous recession. Maybe one of the worst of the past 25 years.

The Fed, he explained, has been inadequate to respond. Insana thinks the Fed should slash the rate to 1% if necessary. Now that's insane and intelligent.

The Fed, he explained, has been inadequate to respond. Insana thinks the Fed should slash the rate to 1% if necessary. Now that's insane and intelligent.

RIMM crashing no more?

Could it be? Has Research in Motion turned the tide? Are BlackBerries withstanding the economic slowdown? According to Lehman Brothers, sales for January are juicy. Get it? Blackberry. Juice. Never mind. RIMM is up 5.4% to 89.56 moments before the close. It was at 82 just a few days ago.

>> What Recession? BlackBerries Selling Great! (RIMM)

>> What Recession? BlackBerries Selling Great! (RIMM)

Apple sweet again?

AAPL was on sale at 117 mid-day recently. Now it's up to 122 plus and the price is still cheap in the eyes of some. Romeo Dator (All American Equity Fund), Darren Chervitz (Jacob Internet Fund) and Gary Bradshaw (Hodges Capital) are bullish.

>> Apple Ready to Shine Again

RIMM is up today, as well, and AMZN announced a $1 billion share buyback. That's a lot of money. Enough to fly to the moon and back a few times.

Apple might be worth dipping into below 120, but at 122? I'm not convinced the bears who pounded AAPL down from 200 are done yet. I need to see massive volume before I think about wading back in. Even as I type away on my trusty ol' PowerBook.

>> Apple Ready to Shine Again

RIMM is up today, as well, and AMZN announced a $1 billion share buyback. That's a lot of money. Enough to fly to the moon and back a few times.

Apple might be worth dipping into below 120, but at 122? I'm not convinced the bears who pounded AAPL down from 200 are done yet. I need to see massive volume before I think about wading back in. Even as I type away on my trusty ol' PowerBook.

Why Yahoo + Google would be a nightmare

Michael Arrington breaks down the illogical long-term consequences of a possible Yahoo-Google agreement. He makes it simple enough that, well, even a Yahoo loyalist would have to agree.

>> Yahoo Board to Decide Fate of Company Today

>> Yahoo Board to Decide Fate of Company Today

Thursday, February 7, 2008

Disney longs in fantasy land?

Still holding my DIS shares, which rose above 32 today in after-hours trading. Last trade was at 32 even. No reason to fear the future, but I am concerned about holding DIS beyond the short term. Can Disney be recession-proof? We don't know. We only know that the recent quarter was stellar.

Corey Rosenbloom thinks DIS is headed back down, in probability.

>> We’re Going to Disney Land!

Citi Investment Jason Bazinet was wrong about his sell call on DIS last week, but is still a bear. David Miller (SMH Capital) thinks the opposite. He expects DIS to hit 44 this year.

>> Disney Q1 results keep bears at bay

Corey Rosenbloom thinks DIS is headed back down, in probability.

>> We’re Going to Disney Land!

Citi Investment Jason Bazinet was wrong about his sell call on DIS last week, but is still a bear. David Miller (SMH Capital) thinks the opposite. He expects DIS to hit 44 this year.

>> Disney Q1 results keep bears at bay

Apple still sour?

OK, there are some folks (like Howard Lindzon) who like Apple at these levels. More so, when it plunged to 117 early today. But with more and more negative news rolling out almost every day, I can't imagine Apple at a bottom just yet. I am afraid to get any position in my favorite company's stock. Where's the catalyst? The street has pummeled AAPL as badly as they've abused RIMM. Merciless. I'll stay out.

>> Apple Component Orders Down (AAPL)

>> Apple Component Orders Down (AAPL)

Blodget's proposal has common cents

Like him or not, Henry Blodget is churning out insights and even solutions for the Microsoft-Yahoo bizarro circus.

>> Here's a Better Deal

So, what's the answer? Jerry and Steve hammer out a deal in which Microsoft trades its Internet division plus $10-$15 billion of cash for half of a stand-alone Yahoo (the exact percentage, board seats, etc. depending on the amount of cash). Steve can be chairman. The new board can agree on the management team.

>> Here's a Better Deal

So, what's the answer? Jerry and Steve hammer out a deal in which Microsoft trades its Internet division plus $10-$15 billion of cash for half of a stand-alone Yahoo (the exact percentage, board seats, etc. depending on the amount of cash). Steve can be chairman. The new board can agree on the management team.

Top 25: #24 Microsoft

Top 25: #23 Nike

Top 25: #22 Baidu

Top 25: #20 Amazon

Top 25: #19 lululemon athletica

Wednesday, February 6, 2008

Top 25: #18 CNOOC Ltd.

OK, I just realized that all my graphs have been on a time frame I didn't mean to use (from July on). I prefer a 1-year graph. Oh well. CNOOC's chart will be the only one that is a 1-year. What do I see? I see chaos. I'm staying the hell away. CEO will look attractive at 122. Or 92. I remember liking this stock a LOT at those levels. I was too chicken to jump in back then, still am now.

Top 25: #17 Focus Media

Top 25: #16 Chipotle Mexican Grill

Top 25: #15 Goldman Sachs

Subscribe to:

Posts (Atom)