Looking at FAZ, FAS and DGP before the market opens wasn't something I particularly enjoyed. It's something I made myself do, at least to keep in touch with a small sliver of the market. I haven't made the time to keep track of the mess in the ECU or stateside and I frankly don't miss it. I'm sure the break will be extended.

FAZ daily

Breaking 42 wasn't something I assumed would happen.

35, I wrote awhile back, is where I'd really get interested.

Now we have a pennant for the first time in weeks.

I'll watch from the bleachers.

FAZ daily

Pre-premarket has FAZ trading below 40.

FAS daily

The run from sub-9 to 15-plus was sudden and severe.

The banksters would not and will let Eurozone interests fail.

FAS daily

Like FAZ, a pennant has formed, which often indicates

a big move is coming soon.

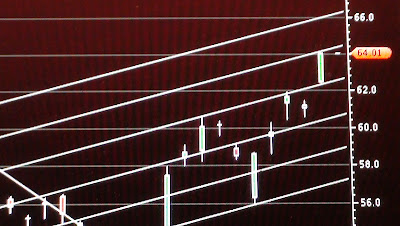

DGP daily

Haven't kept track of gold and silver spot price in ages.

These trendlines are clearly bullish, but I've stayed out.

DGP daily

The trickeration of the puppeteers is a major reason

why I'm in no rush to leap into the fiery lake of gold

No comments:

Post a Comment