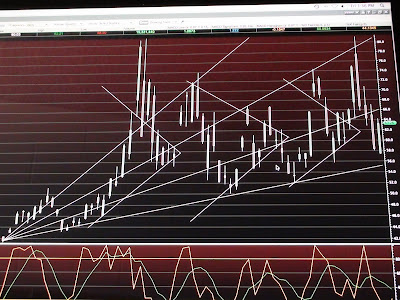

FAZ 1-minute: Whales in action

10:07 am (Hawaii) Clarity. Quite obvious now just from observation of the charts. When FAZ moves up incrementally on the 1-minute chart, retail is stepping in. But the long, long candles make it clear that hedge funds (my guess) are playing FAZ and playing peons like me.

• In premarket, hedgies sold off: a huge gap down from 59 to 58.20, then to 57.20 in 2 minutes.

• Retail bargain hunters stepped in at 56.50 and marched it forward and higher to 57.30 before the opening bell.

• Mix of retail and big buck hedgies as FAZ moved up to 59.80, cutting right through the noise at yesterday's closing price (58.35).

• After hitting 59.80, huge sell by the hedgies brings it back to 58.80 and lower. FAZ consolidates between 9:55 and 10:30 am (Eastern).

• Big move up by hedgies takes FAZ from 58.45 to 60, retail traders tagging along. A couple of hiccups for quick traders, then on to 60.80.

• More incremental buying, machines humming as FAZ goes to 61.20 by 11:20 am.

• FAZ consolidates again between 60.30 and 61. A pop to 61.80 looks strangely timed, followed by immediate selling. Hedgies unloading and getting their price.

• From 60.50 to 62.50, mass volume and price action by hedgies. A bit of consolidation from 12:30 to 12:40 pm.

• Hedgies step in again, the run ain't done. FAZ moves to 63.10, pit stop rest, then up to 63.80 with plenty of retail buying.

• Finally, a first major sell by the market, FAZ dropping to 62.40 almost in a direct downtrend line.

• FAZ makes a desperate rally to 64.15 as retail jumps in head first. I am among the lemmings.

• From 64.15, the selling is pronounced by hedgies, who are up huge for the day. FAZ goes right to 63.30 in 4 minutes, some retail buys in to push price back to 63.70, but hedgies are still unloading as FAZ goes down another flight of stairs to 62.70. I'm out by then. Sucker.

• FAZ tries to make another run to 64, but the tank is almost empty. A huge hedgie selloff takes price from 63.10 to 62.20 in a single minute. FAZ bounces back up to 63.20 and seems to be consolidating, but selling pressure is putting a lid on the pot.

• After somewhat consolidating from 2:00 to 3:00 pm, the hedgies have had enough and bail out. FAZ falls off the mini-cliff to 60.50 by 3:30 pm as the indices rally.

• The hedgies re-enter after that, buying FAZ up from 62.30, then a huge push so fabricated that even I smelled something horribly stink. FAZ goes to 64.02 by 3:59 pm, a nearly 6% gain in less than 30 minutes. It's all hedge fund action, huge candles and volume, hoping to stiff retail traders with one last chaser scenario.

I think, a small position going into next week would be nice, even at 64. But I think the price falls in afterhours trading, and this is a pure setup move by the hedgies, so I pass.

Afterhours, FAZ is at 63.39, up 9.8% today. When it sold off to 60.50, it was roughly 2.5% up. Just another day of FAZ movement. And I'm convinced more than ever that dealing with FAZ is about price discipline and being selective, not chasing momentum. Had I stuck with 55 and 60 as buy points — 55 is at the low end of my megaphone/pennant patterns chart — I would've missed a buy in premarket trading. But I would've gotten in at 60. Maybe a set buy order at certain price points would be far better for me, particularly when I'm asleep during the early hours.

There's no way to beat the hedgies. At best, peon traders (like me) can follow their moves like pilot fish to sharks. But ultimately, price points rule. A buy at 56+ premarket won no matter how much turbulence was in FAZ during the session. I noted yesterday that FAZ's last move down from 81 was all the way to 54+. 56+ is close enough, and I was looking for 55. But I wasn't set with a buy order at that level or 60, so the onus is on me to have my thesis, detail my process and execute with conviction. That would be superior to chasing at 63 or 64, wouldn't it?

Even the late day selloff to 60.50 should've rang bells for me as a possibly buy point. I might be best served with charts on paper (stationary observation) rather than live charts that can be highly seductive because of the chase element. In other words, it's time to get more nerdy about my charts and more so my actions. No nerd chases something that's at 64 after it was 56 that same day. He takes out his butterfly net and calmly brings in his catch at 56 and 60.

From here, 66-67 has been a mid-point of sorts with the next megaphone level as high as 81 (again). This could quickly fall to 55 though my hope for 50 or 42 is fading. The chances are higher now of a run back to 81 and then 100.

Update 1:36 pm I enjoy interpreting the price action via the daily chart. Too bad I haven't utilized the information much at all. At 63 and change afterhours, FAZ is well above its earlier low at 56+. In other words, the buying opportunity has passed unless someone knows more downgrades like the one today by Fitch (of Italy and Spain) are coming on Monday.

FAZ daily: megaphones only

FAZ daily: adds pennants

I noted yesterday that it was the first time since the FAZ explosion in August that price had declined with three consecutive long candles. It had to come to an end or it would become the beginning on an ugly drawdown, which I would've welcomed. I still have fantasies of buying FAZ at 50 or 44 or 42. But here at 63+, I feel compelled to open a small position, period. The vast evidence points to the necessity of a financial breakdown to bring Europe and, eventually, the US. Reaching a state of solvency cannot happen without wiping the balance sheets clean, and it cannot merely disappear into thin air, though we have been thoroughly convinced up to this time that it is done with regularity and efficiency.

Update 1:58 pm Small position FAZ 63.20.

No comments:

Post a Comment