Nintendo NTDOY.PK whacked it out of the park with its gigantic revenues and profits.

If it's one thing about the Japanese market, the fluff and wild speculation are just not, well, fluffy and wild. Think about it. While we have intrigue and bubble thoughts hovering over China — not to mention the way the government's ownership in major stocks — it's not so in Japan. Savings rates among citizens are astronomically high, as always, and bubble-icious stocks are not as prolific as they are in China or the U.S.

If it's one thing about the Japanese market, the fluff and wild speculation are just not, well, fluffy and wild. Think about it. While we have intrigue and bubble thoughts hovering over China — not to mention the way the government's ownership in major stocks — it's not so in Japan. Savings rates among citizens are astronomically high, as always, and bubble-icious stocks are not as prolific as they are in China or the U.S.That's not why I am so devoted to Nintendo, however. It's about the numbers, which don't lie. That's why I'm backing up my bullish stance (and holding) by moving NTDOY.PK from B+ to A-.

Finally.

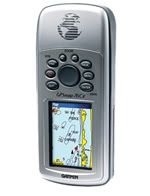

Garmin This is a Co that was on my B list when it should've been at B+, which is where I'm moving it today. Not understanding what the Co does is a large reason why I paid so little attention to it. Strictly on the numbers, though, I liked it at the B level. GRMN's earnings report is due out on Wednesday.

Garmin This is a Co that was on my B list when it should've been at B+, which is where I'm moving it today. Not understanding what the Co does is a large reason why I paid so little attention to it. Strictly on the numbers, though, I liked it at the B level. GRMN's earnings report is due out on Wednesday. Demoted:

Spartan Motors As a Co, not much has changed for SPAR. Landing contracts (or not) is a way of life, an irrefutable fact of life that alters its stock. But the flip side of it is that the fundamentals of Spartan won't make investors a profit unless revenues are realized, and without the latter, the stock has tumbled mightily. As much as I rely on a Co's fundamentals, stocks are about popularity to an unfortunate, but real extent.

Spartan Motors As a Co, not much has changed for SPAR. Landing contracts (or not) is a way of life, an irrefutable fact of life that alters its stock. But the flip side of it is that the fundamentals of Spartan won't make investors a profit unless revenues are realized, and without the latter, the stock has tumbled mightily. As much as I rely on a Co's fundamentals, stocks are about popularity to an unfortunate, but real extent. Is yesterday's $1 million stock buyback going to turn the tide? With the earnings miss (by 6 cents per original estimate), that'll be tough. The Co is quite the same. Traders who ran it up and knocked it down ... they're the real Jekyll and Hyde here. The real longs will scoop up cheap shares here at $12, particularly with 40% annual growth coming, according to the Co.

Hoku Scientific Demoted from B- to C+. Great prospects, dwindling revenues (per last week's earnings report), huge promises. HOKU is not your average small cap. It's the equivalent of taking a promising young baseball player out of the minors after a short stint and starting him on a major-league team. Hard-working player, diligent on and off the field, but at least a year or two from hitting his stride.

Hoku Scientific Demoted from B- to C+. Great prospects, dwindling revenues (per last week's earnings report), huge promises. HOKU is not your average small cap. It's the equivalent of taking a promising young baseball player out of the minors after a short stint and starting him on a major-league team. Hard-working player, diligent on and off the field, but at least a year or two from hitting his stride. Opposing fans ride him incessantly for his hefty paycheck. Home fans dote on him and believe he will develop into an All-Star in due time. HOKU traded up today, but at $9 is well off its high in the $14 range. This is likely a trader's dream for the coming 18 months.

Volcom An earnings miss has pulverized the stock, which traded today at $38, a 14% haircut. I own a Volcom surfer wallet and like it. However, unless some new products enter the market, VLCM is going to trade sideways for some time. Retail is a rough market, more so with an outdoor-oriented Co that misses in what should have been its best season of the year. I demoted VLCM from B to C+.

Volcom An earnings miss has pulverized the stock, which traded today at $38, a 14% haircut. I own a Volcom surfer wallet and like it. However, unless some new products enter the market, VLCM is going to trade sideways for some time. Retail is a rough market, more so with an outdoor-oriented Co that misses in what should have been its best season of the year. I demoted VLCM from B to C+.  Joy Global Earnings aren't due for another month, but a guidance cut from JOYG sent the shares down 14% on Wednesday.

Joy Global Earnings aren't due for another month, but a guidance cut from JOYG sent the shares down 14% on Wednesday. Demoted down to C+ by Pupule.

Dendreon The silence from top brass is deafening. Insider sales, including those by CEO Mitchell Gold, before the stock took a major plunge off a cliff on May 9, still haven't been explained sufficiently by the Co. Worse yet, the lack of transparency has the SEC mired in an "informal inquiry" of DNDN and its clinical trials.

Dendreon The silence from top brass is deafening. Insider sales, including those by CEO Mitchell Gold, before the stock took a major plunge off a cliff on May 9, still haven't been explained sufficiently by the Co. Worse yet, the lack of transparency has the SEC mired in an "informal inquiry" of DNDN and its clinical trials. Provenge is Provenge, a potentially life-extending immunotherapy treatment for prostate cancer patients. However, DNDN has shown no signs of life when it comes to navigating the treacherous waters of the FDA, hedge funds and big pharma. Provenge has been shelved for much too long, and no reason the Co has given can excuse the delay for patients.

Demoted from C to D+. Sadly, until management is shaken up or overthrown, Provenge will remain locked up.

Pupule Paul is long NTDOY.PK, HOKU and DNDN.

No comments:

Post a Comment